Waterways Transport: Statistics, Challenges, Initiatives & More | UPSC Notes

Waterways Transport

India is a land of rivers surrounded on three sides by ocean. It has around 7500 kilometres of coastline and 14,500 km of potentially navigable waterways. Moreover, it is strategically located on key international trade routes. This unique natural resource and strategic geographic location endow India with vast potential in trade. And most importantly, the maritime sector is becoming critical from the geostrategic perspective.

Waterways transport includes two categories: maritime transport and inland water transport.

Maritime Transport: It is a critical infrastructure for the economic development of a country. It influences the pace, structure, and pattern of development.

Ports

- Ports provide an interface between land-based transport and water-based transport.

- India has 12 government-owned major ports and approximately 200 minor and intermediate ports. The states and the Centre administer these ports.

- Constitutional provisions: Major ports are under the Union List. Other ports are under the state list.

- Major Ports are administered under the Indian Ports Act of 1908 and the Major Port Trust Act of 1963.

Major Ports

- Some key facts about ports:

- Kandla Port was the first port to be developed to ease trade on Mumbai Port and in the wake of the loss of Karachi port to Pakistan. It is a tidal port. It sits on a highly productive granary and industrial belt stretching across the states of J&K, Himachal Pradesh, Punjab, Haryana, Rajasthan and Gujarat.

- Mumbai Port is the largest port with a spacious natural, and well-sheltered harbour.

- Jawaharlal Lal Nehru Port (JNPT) was planned to decongest the Mumbai port and serve as this region’s hub port.

- Marmugaon Port (Goa) is the country’s premier iron ore exporting port, with 50% share in India’s iron ore export.

- New Mangalore Port caters to the export of iron ore concentrates from Kudremukh mines.

- Kochi Port is in the extreme southwest of India. It is located at the entrance of a lagoon with a natural harbour.

- Tuticorin Port (Tamil Nadu): It is in India’s extreme South-East. It has a natural harbour and a natural hinterland. It handles a variety of cargoes (even to Sri Lanka and Maldives).

- Chennai Port: It is one of the oldest artificial ports. It is second, next only to Mumbai port, by volume of trade and cargo.

- Vizag Port is the deepest landlocked, and well-protected port conceived initially to export iron ore.

- Paradip Port (Odisha): It specializes in iron ore export.

- Kolkata Port: It is an inland riverine port. It serves the vast and rich hinterland of the Ganga-Brahmapurta basin. Being a tidal port, it requires consistent dredging of the Hoogly river.

- Haldia Port (Diamond Harbour): was developed to relieve growing pressure on Kolkata port. It is a tidal port.

Shipping:

- Shipping is indisputably the world’s most efficient mode of transportation. Its carbon footprint is about half of the road sector. It reduces the pressure on railways and roadways.

- It has a vital role in international trade and, therefore, the economic development of a nation and is a great contributor to ForEx earnings. In addition, it plays a critical role in India’s energy security. It also serves as a second line of defence by providing uninterrupted services in the face of crises.

- Cruise Shipping is a fast-growing component of the leisure industry globally. It brings significant ForEx, creates sizable employment opportunities and leads to the development of allied services in the vicinity.

Shipbuilding:

- The shipbuilding industry is one critical area that can help India harness its enormous potential available in water transport.

- It gives a boost to ancillary industries and therefore produces multiplier effects.

- Factors driving the shipbuilding and ship repair sector:

- An uptick in global trade and commerce.

- Evolving environment-friendly regulations.

- Domestically, the development of coastal shipping and inland waterways are additional drivers.

- The urban transport segment and short-sea shipping market using environment-friendly mobility also offer opportunities for shipbuilders.

- Ex: Cochin Shipyard is building 23 passenger boats using hybrid battery propulsion for Kochi Metro Rail.

- Maritime Clusters: These provide ancillary services, manufacturing ancillary products, maritime products, maritime services, and financial services for the shipbuilding industry.

- Proximity to major shipping routes, the steel industry, shipyards and ports have favoured the proposed development of a maritime cluster in Tamil Nadu.

- Gujarat is also working on developing a Marine Shipbuilding Park in Bhavnagar along with a Maritime Services cluster in Ahmedabad or Gujarat International Finance Tec-City (GIFT) City.

Ship repair:

Shipowners prefer to repair their ships at shipyards closer to their trade routes. It is a labour-intensive industry and uses the existing shipbuilding infrastructure.

Inland Waterways

- The Inland Water Transport (IWT) mode is widely recognized as fuel efficient, environment-friendly, and cost-effective, especially for bulk goods, over-dimensional cargo, and hazardous goods. It also reduces the pressure on the road and the railways. In addition, it can facilitate regional development.

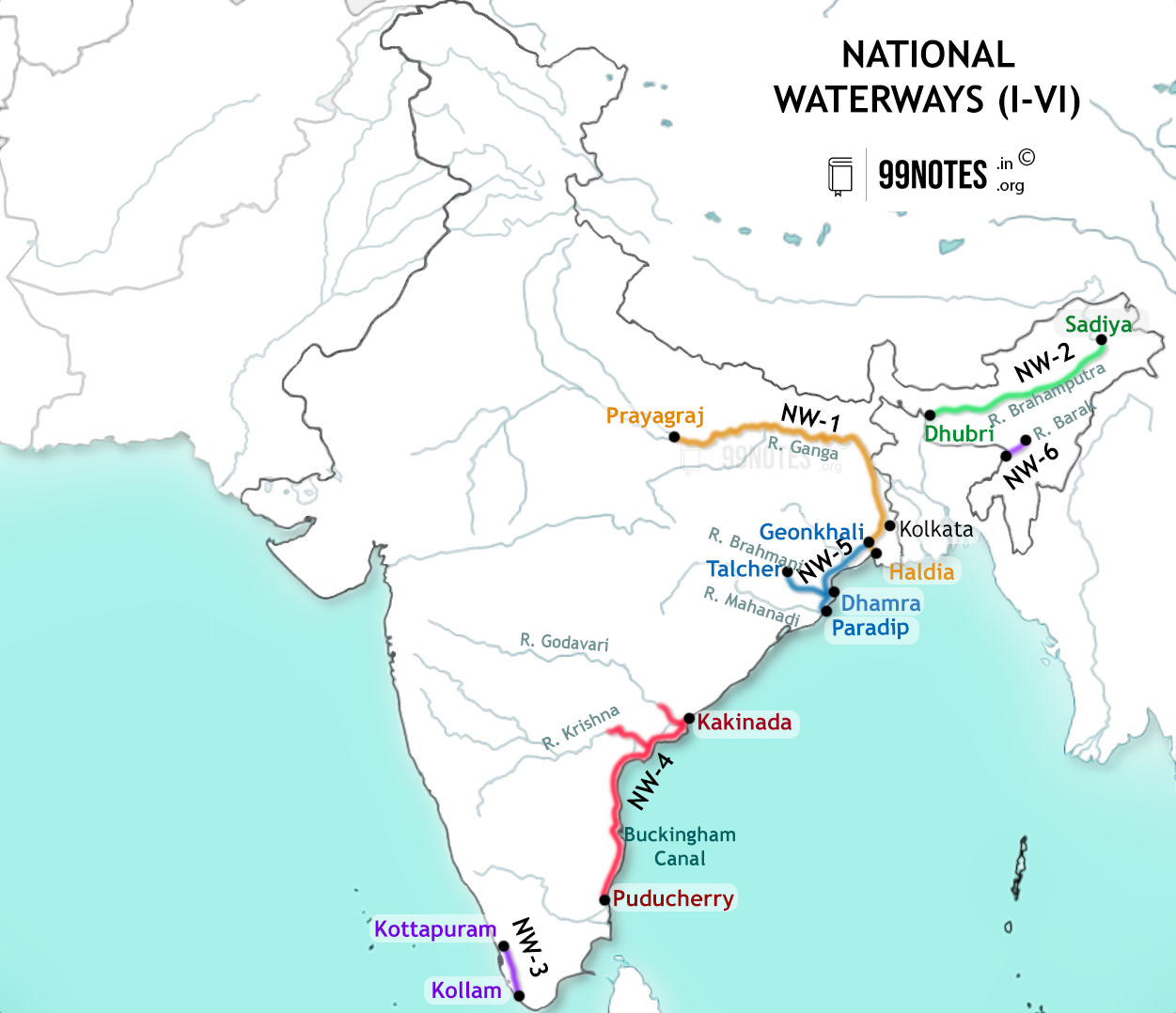

- Inland Waterways Authority of India (IWAI) was instituted in 1986 under the Inland Waterways Authority of India Act, 1985, to regulate and develop inland waterways for shipping and navigation, and is inter-alia responsible for the development, maintenance and regulation of National Waterways (NWs). Other inland waterways fall under the purview of the state government.

Status in India

| Ports |

|

| Shipping |

|

| Shipbuilding |

|

| Ship repair |

|

| Ship Recycling |

|

| Inland Water Transport (IWT) |

Other waterways: Godavari, Krishna, Barak, Sunderbans, Damodar Valley Cooperation canal, etc. |

Challenges in the Ports Sector

- Ports infrastructure

- Lack of warehousing capacity

- Lesser number of ports.

- No-world class ports.

- Lesser private participation.

- Lacking evacuation infrastructure.

- Poor hinterland connectivity is a major issue.

- Multiple agencies are involved in infrastructure development.

- Imbalanced infrastructure (onshore vs sea)

- Port handling capacity is low.

- Handling equipment.

- Low draught levels:

- Per international standards, a minimum draft of 18 metres is needed to enable mother vessels to dock at the ports. However, most of the major ports of India have a draft level of at least 14 metres.

- The highest annual siltation load is at the Cochin port.

- Dredging is needed to increase the draught levels to match international standards.

- Outdated navigational aids and IT systems.

- Poor turnaround time.

- Delayed custom clearance.

- Lack of standardized operations: It leads to a lack of uniform service standards across the major ports.

- Red-tapism due to extensive paperwork, government approvals, and environmental clearances.

- Human Resources

- Lack of skilled workforce.

- Labour strikes decrease workers’ productivity.

- Port-specific issues – siltation (Haldia port), semi-mechanization (Paradip port), congestion (Mumbai port), small size (Mormugaon Port).

- Port development and management issues

- Dual institutional structure – Central government for Major ports and state government for other ports.

- Multiple agencies are involved in the decision-making process.

- No independent dispute settlement boards.

- 100% FDI not realized due to security issues.

- Delayed land-leasing approval.

- Inter-ports competition: Similar infrastructure developments have occurred in multiple-cargo handling ports. There has been a scant focus on creating regional cargo-specific ports has been. As a result, there is competition between the Indian ports for the same cargo.

- Other issues:

- Port charges are higher than in developed countries.

- Poor performance of government-owned ports as compared to private ports.

Challenges in the Shipping Sector

- Ageing fleet

- Insufficient national fleet

- India’s shipping industry and shipping fleet are smaller than its global counterparts.

- Regarding capacity, the Indian fleet has a global share of below 2%.

- Higher operating costs of the shipping industry owing to IGST on import of ships, blocked GST tax credits, higher cost of debt funds, customs duty on bunkers, landing fees, and taxation on seafarers’ wages. It leads to an outgo of large sums of ForEx.

- 3rd generation ships are not able to enter the harbours.

- Lack of lucrative schemes for shipping companies in India.

- Dependence on foreign vessels: The shipping infrastructure in the ports helps the foreign shipping liners. Shipbuilding, repair, and ownership are yet to gain traction in India. Moreover, the Indian maritime business community have, instead of owning ships or container liners, become agents of foreign shipping or container liner. They prefer a foreign registry of their ships instead of a domestic registry. It leads to a significant ForEx outgo in the form of enormous hidden charges. Relaxing “Cabotage” regulation in the name of coastal shipping has further amplified this problem.

- Recent issues:

- A downturn in cargo movement and cruise shipping due to the Covid-19 pandemic.

- Global uncertainty in the shipping industry due to trade disputes, the Russia-Ukraine war and the introduction of the global 0.5% sulphur cap on marine fuels.

Challenges in the Shipbuilding and Ship Repair Sector

- Lack of skilled workforce

- Lack of latest technologies

- Competition from shipyards in Dubai, Bahrain and Colombo, which are located favourably on international trade routes.

- Capability gap of Indian yards in repairing certain kinds of vessels.

- GST makes Indian ship repairs uncompetitive.

- High cost of financing

- Lack of supply of ship spares in India.

Due to the above factors, of the total 24 shipyards in the country, only 6 do some major ship repair work. Ship repair execution cycle time is also on the higher side.

Challenges in the IWT sector

- Geographical

- Peninsular rivers are non-perennial. Huge seasonal fluctuations.

- International Obligation: For example, Under the Ganga river water treaty, India has to share 50% of the water during the lean season, which forces us to reduce the water flow at Hugli port.

- Climate Change: This has created uncertainty regarding the flow in the rivers we expect in the long term.

- The problem of siltation in northern rivers and canals.

- Reduced water levels due to the diversion of water for agricultural uses.

- Salinity in the coastal stretches.

- Most rivers are of small length limiting their geographical coverage.

- Traffic disruptions due to bad weather.

- Technical

- Inadequate water draft levels. However, carrying out dredging works can cause harm to biodiversity.

- Lack of satisfactory navigational aids

- The problem of land acquisition for the development of terminal infrastructures.

- Slow speed of transport

- Infrastructure

- Lack of terminals

- Shortage of vessels for inland transport

- Lacking MRO facilities

- Lacking seamless connectivity with other modes of transport.

- Financing

- Slow growth in public expenditure in the sector.

- Lack of private financing due to long gestation periods.

- Regulatory Issues

- Modal integration

- Policy parity with other modes of transport is lacking.

- Separation of powers: Central government can develop an Inland waterway for navigation only when it is declared a National Waterway by an act of Parliament.

- Multiple local regulations.

Government Initiatives

1. Government Initiatives For Ports

1. Sagarmala is a holistic programme for port-led development covering all the aspects of water transport, including increasing ports’ efficiency.

2. Major Ports Authority Act 2021

| Major Ports Authority Act 2021 |

| It aims to create a Board of Major Port Authority for each of the Major Ports, replacing the existing Port Trusts under the Major Port Trust Act 1963.

1. Composition of Board:

i. respective state governments, ii. the Railways Ministry, iii. Defence Ministry, and iv. Customs Department.

2. Powers of the Board:

i. Declaring the availability of port assets for port-related activities and services, ii. Developing infrastructure facilities such as setting up new ports, jetties, and iii. Providing exemption/remission from payment of any charges on any goods or vessels.

i. Earlier: Board had to seek the prior sanction of the central govt to raise any loan. ii. Now: to meet its capital and working expenditure requirements, the Board may raise loans from any: (i) scheduled bank or financial institution within India or (ii) any financial institution outside India that complies with all the laws.

i. Earlier: Tariff Authority for Major Ports, established under the 1963 Act, fixes the scale of rates for port assets and services. ii. Now: the Board/its committees will determine these rates for:

i. Areas: Infrastructure development in education, health, housing & skill development. ii. These benefits could be provided for the Board’s employees, customers, business partners, local communities, environment and society.

i. The Board may fix the tariff for initial bidding purposes. ii. The appointed concessionaire will be free to fix the actual tariffs based on market conditions and other conditions as may be notified.

i. Composition: a Presiding Officer + 2 members, as appointed by the central govt. ii. Functions:

i. Earlier: Various penalties For example, (i) for setting up any structures on the harbours without permission – Rs 10,000; (ii)for evading rates – up to 10 times the rates. ii. Now: any person contravening any provision of the Bill or any rules or regulations will be punished with a fine of up to 1 lakh rupees. |

3. Draft Indian Ports Bill 2022

| Indian Ports Bill 2022 |

|

4. Port handling capacity to be raised by 4X the capacity in 2020 by 2047.

5. Investments:

- 100% FDI is allowed in port and construction of harbour and maintenance.

- Maritime India Vision (MIV) 2030 estimates investments of ₹1-1.25 lakh Cr for capacity augmentation and developing world-class infrastructure at Indian Ports.

- New Model Concession Agreement – 2021 for Public-Private-Partnership (PPP) Projects at Major Ports.

6. National Logistics Portal-Marine: a single-window logistics portal launched in 2023 to reduce logistics costs.

7. Gati Shakti– National Master Plan for Infrastructure development

8. Workforce capacity building:

- School of Logistics, Waterways and Communication inaugurated in Agartala.

- India’s first Centre of Excellence for Green Port and Shipping.

- Logistics Data Banks (LDB): All major ports have been sanctioned an LDB. It can boost foreign trade, increase EODB, decrease container movement lead time, and reduce transaction costs.

- Port Community System (PCS1x)

i. It is a cloud-based new-generation technology with a user-friendly interface that seamlessly integrates stakeholders from the maritime trade on a single platform.

ii. Significance:

- Facilitates improved communication with the customs enabling API-based real-time interaction.

- Reduces errors in the process.

- Decrease the dwell time.

- Reduce by a minimum of 1.5-2 days from the transaction’s life.

- Decrease the overall cost of the transaction.

- Increase EODB and Logistics Performance.

2. Government Initiatives For Shipping

1. Marine Aids to Navigation Act 2021

- It will facilitate harmonized and effective functioning of aids to marine navigation and Vessel Traffic Services along the Indian coastline.

2. Merchant Shipping Bill, 2020 and Coastal Shipping Bill to replace Merchant Shipping Act, 1958.

3. The Admiralty (Jurisdiction and Settlement of Maritime Claims) Act 2017.

4. Centre of excellence in Maritime and Ship Building under Sagarmala Project at Vishakhapatnam and Mumbai. It will skill the workforce in ship design, manufacturing, operating, maintenance, repair and overhaul.

5. A policy of 100% FDI in shipping has been available since 1997.

6. Project Sethusamudram

- It is a proposed shipping route between Sri Lanka and India in the shallow straits. It will provide a continuously navigable sea route around the Indian peninsula.

7. A scheme for promoting flagging merchant ships in India by providing subsidy support to Indian shipping companies in global tenders floated by Ministries and CPSEs.

8. Subsidy Scheme to boost merchant ships.

- It provides subsidy support to Indian Shipping companies in global tenders floated by the Ministries and the CPSEs to import government cargo. As a result, it results in significant ForEx savings and gives strategic advantages by reducing excessive dependence on foreign ships for transporting India’s critical cargo.

3. Government Initiatives For Shipbuilding and ship repair industry

- Container Manufacturing Hub: Bhavnagar in Gujarat is being developed as a container manufacturing hub.

- PLI scheme for shipping containers.

- Shipbuilding has been identified as one of the key sectors under the ‘Make in India’ initiative.

- New Shipbuilding Financial Assistance Policy for Indian Shipyards: Launched in 2015, it provides financial assistance of up to 20% of the lowest among the “Contract Price” or the “Fair Price” or actual payments received for each vessel built by Indian Shipyards. This assistance is available for 10 years (FY17-FY27), and the 20% rate is to be decreased by 3% every year.

- Right of First Refusal to Indian Shipyards is available between 2015 and 2025 for procuring or repairing vessels meant for government or own use.

- Standalone’ Shipyards’ were added to the Harmonized Master List of Infrastructure Sub-Sectors in 2016.

|

7. International Ship Repair Facility is being developed at Cochin Shipyard Ltd. (CSL). Some renowned firms in the maritime industry have partnered with CSL to set up their units in the Maritime Park in the first phase. CLS expects to position Kochi as a major ship repair hub.

8. In 2020, changes were made in the guidelines for chartering vessels through a tendering process to facilitate Make in India for shipbuilding.

9. Cabotage has been relaxed till 2029, allowing foreign flag passenger/cruise ships to call at more than one Indian port.

Government Initiatives For Inland Water Transport

- National waterways – development of existing and 106 notified waterways.

- Jal Marg Vikas Project-I on NW-1 – aimed to develop the river Ganges as a safe navigation mode.

- A World-Bank-supported project to be developed between Haldia to Varanasi.

- Fairway Development Works ensure the Least Available Depth (LAD) of 3.0 meters is undertaken in various sections of the NW-1.

- Multi-modal terminals have been developed at Varanasi, Haldi, and Shahibganj.

- Navigational Lock at Farakka

- Intermodal terminal at Kalughat and Ghazipur

3. Jal Marg Vikas Project – II (Arth Ganga)

- ‘Project Arth Ganga’ envisages re-engineering the JMVP by involving the local community, focusing on economic activities in and around the Ganga River.

4. Inland Vessels Bill 2021 passed.

- Replaces the century-old Inland Vessels Act 1917.

- To bring all inland waterways in India and the movement of vessels on them for any purpose under a central regulatory regime.

- Objective: unification of laws for the vessels plying and boosting infrastructure through the Jal Marg Vikas Project.

5. Development of New National Waterways-IWAI has identified 26 new NWs through techno-economic feasibility studies for undertaking technical interventions to make the waterways navigable for transportation purposes.

6. National Inland Navigation Institute (NINI) at Patna – Established in 2004 to develop human resources for the Inland Water Transport Sector.

7. Ro-Ro/Ro-Pax Service Commenced in Various National Waterways.

8. Indo-Bangladesh Protocol on Inland Water Transit &Trade (PIWTT) – It is a protocol for mutually beneficial arrangements for the use of their waterways for the movement of cargo between the two countries for passage of goods between two places in one country through the territory of the other, per the laws of the country through the territory of which goods are moving.

Others

- National Maritime Heritage Complex

- Recycling of Ships Act 2019. The Recycling Rules 2021 have been notified.

Way Forward

- Expedite the implementation of Sagarmala.

- Ports:

- Create regional cargo-specific ports, develop state-of-the-art infrastructure, and provide excellent connectivity to the hinterland and the sea routes. In addition, it will enable the ports to become transhipment hubs.

- Open India’s dredging market.

- Ease the business environment around shipping and ports.

- Shipping and shipbuilding and repairs:

- The shipping community needs to be encouraged for ship-owning and shipbuilding.

- Coastal communities and old sailing vessel owners can be encouraged to own small ships. This way, the minor ports will emerge as transhipment hubs as they service the major ports.

- Inland waterways

- Enhance last-mile connectivity to inland waterways.

- Facilitate access to capital for inland vessels.

- Address technical and regulatory constraints in inland waterways to ease the movement of inland vessels.

- More waterways by declaring all identified waterways as National waterways

- Construction Inland ports for logistics

- Development of Industrial corridors based on the models of economic corridors along highways. These must be well connected with the riverside ports.

- Interlinking of rivers will enable water transfer to the main channels of major rivers to support transport.

- Harvesting and storing rainwater for utilization in the lean period.

- International cooperation: For example, the construction of Dams in Nepal can store water for the summer.

SAGARMALA

- Aim: To promote port-led development in the country.

- Approved in 2015.

- Vision: To reduce the logistics cost of both domestic and EXIM cargo with minimal infrastructure investments, thereby improving the economy’s overall efficiency and increasing the competitiveness of exports.

- Sagarmala Development Company (SDC) have been formed to support the projects.

- The projects under the Sagarmala are categorized under 5 pillars:

- Port modernization,

- Port connectivity,

- Port-led industrialization,

- Coastal community development and

- Coastal shipping & inland water transport.

- Central and state governments implement these projects, major ports and other agencies primarily through the private or PPP mode.

PILLAR 1: PORT MODERNIZATION

- It involves:

- Expansion of port capacity through the implementation of well-conceived infrastructure development

- Increasing operational efficiency of ports through mechanization, digitization, and process simplification. Dredging is covered under this.

- Addressing environment-related concerns.

- The projects under the modernization pillar are further divided into 4 categories —

- New Ports,

- Port Modernization — Major Ports,

- Port Modernization — Non-Major Ports and

- Ship Repair projects.

- Outcome:

- Average turnaround time improved in FY21 to around 60 hours against 83 hours in FY17.

- The average output per ship berth-day has increased from 14576 tonnes in FY17 to 15855 tonnes in FY22 (8% increase).

PILLAR 2: PORT CONNECTIVITY

- It involves improving connectivity infrastructure connecting ports with domestic consumption and production centres through rail, road, pipeline, and multi-modal logistic parks (MMLP).

- The Ministry of Railways, the Ministry of Road Transport and Highways, Major Ports, Maritime Boards and State Road Development Companies implement these projects.

- Steps taken to expedite projects under this pillar:

- Prioritization and expediting the identified port road and port rail connectivity projects.

- Incorporation of ‘National Highways Logistics Management Limited’ (NHLML), an SPV under the National Highway Authority of India (NHAI). NHLML is mandated to develop MMLP and conduct works related to National Highway connectivity for ports.

- Funding: SPV were allowed between Centre, State and PPP operators for providing CAPEX & OPEX support for the road/rail connectivity projects and may also run the services with profits utilized for making the SPV self-sufficient.

- Focus on creating capacity in the hinterland.

PILLAR 3: PORT-LED INDUSTRIALIZATION

- Aims to reduce logistics costs by locating industries near the ports.

- The projects identified under this pillar are divided into 4 categories:

- Industrial Cluster,

- Maritime Cluster,

- Smart Industrial Port City (SIPC)/SEZ and

- Thermal Power Plant.

- Coastal Economic Zone (CEZ)

- It has been envisaged to facilitate port-led industrialization and/or Export-Import (EXIM) / coastal trade of goods & commodities.

- CEZ is a spatial economic region comprising a large area in a single district or a group of coastal districts or district(s) with strong linkage to ports in that region/vicinity with an intent to reduce the logistics costs from demand/supply centre to port and vice versa.

- It has a dual focus – direct contribution of port traffic coupled with employment generation and reduction of logistics costs.

- Such a zone is envisaged to comprise industrial areas/estates, housing & urban infrastructure, and logistics/transport infrastructure within itself to be a self-contained region with a direct or a strong port linkage.

- Objectives:

- Creating large-scale employment opportunities in the coastal regions across identified sectors to promote development in the coastal areas.

- Increasing India’s EXIM trade competitiveness by reducing logistics costs through proximity and port connectivity.

- Increasing freight traffic through the ports near the industries on account of trade generated by these manufacturing capacities.

- Provide an impetus to coastal shipping by creating supply and demand centres close to the coastline for the domestic movement of goods and passengers.

PILLAR 4: COASTAL COMMUNITY DEVELOPMENT

- More than 60 coastal districts in India are spread across the coastal states/UTs.

- The coastal community is one of the key stakeholders of the Sagarmala Programme, and hence ensuring their social well-being is one of the major objectives.

- It involves the development of fish harbours and the skill development of the coastal community.

- Example: Up-skilling of the coastal population under DDU-GKY Sagarmala Convergence Programme. Under this convergence, the Ministry provides funding support, whereas MoRD carries implementation and management.

- Floating jetties are an alternate solution to India’s over-crowded fishing harbours. Several advantages of floating jetties are:

- Cost-effective

- Faster installation.

- Eases the disembarkation/ embarkation.

- Require no permanent construction offshore.

- Easy expansion & relocation due to modular construction

- 25+ Years of life with minimal environmental impact.

PILLAR 5: COASTAL SHIPPING & INLAND WATER TRANSPORT

- This pillar involves project categories like RORO, ROPax, tourism jetties, seaplanes, infrastructure for coastal cargo handling, cruise shipping, urban water transportation and island development.

- RORO (“roll-on/roll-off”) describes a vessel transporting wheeled cargo. The ships have built-in ramps to make loading and unloading wheeled cargo easier than done with a crane.

- RoPax are vessels built for freight vehicle transport along with passenger accommodation.

- RORO gives land transport a bigger action radius, making it possible to shorten their route through ships instead of diverting to a longer route.

- RoPax services have a direct positive impact – drastically reducing passenger travel time and improving delivery time, and the loading and unloading process is quick and agile.

- These projects have opened new avenues in coastal shipping and tourism and enhanced the socio-economic welfare of its vicinity; fuel-efficient and helps reduce CO2 emissions, reduce traffic on road and rail and prevent loss of human lives caused due to accidents and since there is no loading and unloading at the port, there is less risk of accidents and cargo damage.

- Some examples:

- RoPax Ferry services between Ghogha and Hazira in the Gulf of Cambay – Kandala Port.

- ROPAX service from Bhaucha Dhakka (Ferry Wharf), i.e., Mumbai to Mandwa – JNPT port.

- Seaplane Projects involve constructing water aerodromes at the origin and destination points where the seaplanes will utilize the water bodies for taking off and landing. Advantages:

- Improve connectivity across the nation.

- Make India an attractive destination for tourists.

- Generate employment

- Stimulate tourism and associated business activities.

Example: Brahmaputra riverside and Umrangso reservoir in Assam, Junglighat (Port Blair) in Andamans and Surat in Gujarat.

- Island Development

- India has a total of 1,382 offshore identified islands.

Island development can be across various use cases related to maritime activities (e.g., bunkering, ship breaking etc.), tourism, energy generation, fisheries, agriculture etc.

![What Is Social Infrastructure: Meaning, Importance &Amp; Challenges [Upsc Notes] | Updated December 4, 2025 What Is Social Infrastructure: Meaning, Importance & Challenges [Upsc Notes]](https://www.99notes.in/wp-content/uploads/2023/05/social-infrastructure-99notes-upsc-1-768x512.webp)