Prices and Inflation: Successful Tight-Rope Walking

Introduction

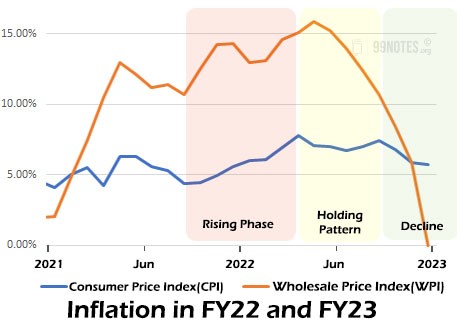

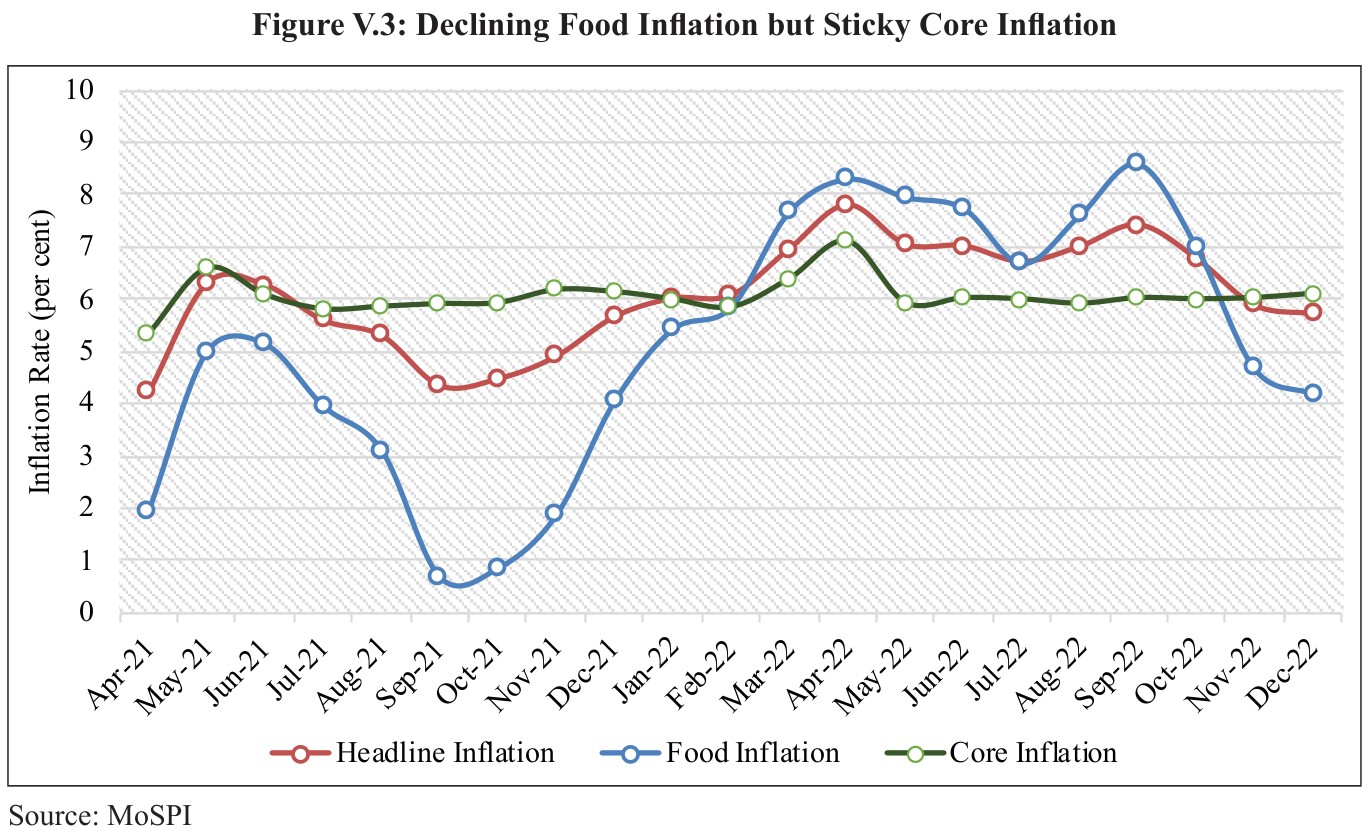

In India, Consumer price inflation went through three phases in 2022.

- A growing phase up to April 2022, when it crested at 7.8 %.

- A holding pattern at around 7.0 % up to August 2022.

- A decline to around 5.7 % by December 2022.

Reasons

- The rising phase was due to the Russia-Ukraine war.

- An adverse crop harvest is due to undue heat in some parts of the country.

Domestic Retail Inflation

- FY22 witnessed lower CPI-Combined (CPI-C) based retail inflation compared to FY21.

- During FY22, ‘oils & fats’, ‘fuel & light’ and ‘transport & communication’ reported high inflation.

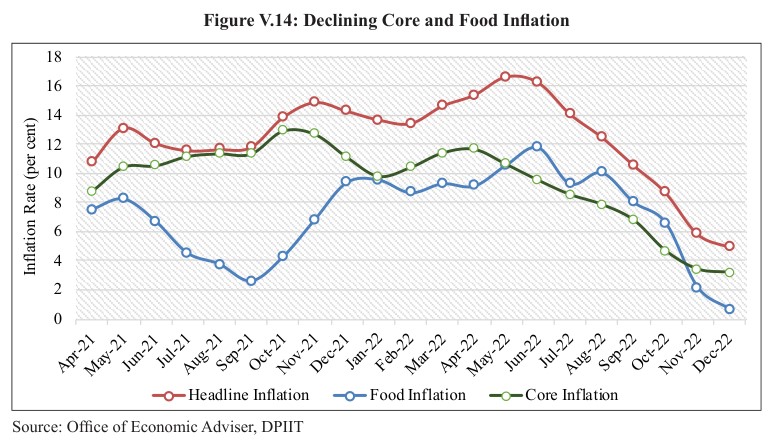

- Retail inflation was predominantly driven by higher food inflation, while core inflation remained moderate in FY23.

- Food inflation was between 4.2%to 8.6% between April and December 2022, while the core inflation rate lay at around 6%except in April 2022.

Retail Inflation Driven by Food Commodities

- Retail price inflation mainly stems from housing, pharmaceuticals, textiles, agriculture and allied sectors.

- During FY23, ‘food & beverages, ‘fuel & light’, and ‘clothing & footwear’ were the key contributors to headline inflation.

- Food Inflation in FY23:

- The Consumer Food Price Index (CFPI) climbed to 7.0% in FY23 from 3.8% in FY22, mainly due to the inflation in Vegetables and cereals.

- Cereals remain inflated mainly due to the Ukraine conflict. Russia & Ukraine account for around 1/4th of the global wheat trade.

- Steps taken by the Government:

- To check the soaring prices of wheat and rice, the government has prohibited the export of wheat products under HS Code 1101, and on rice, an export duty was imposed.

- To protect the vulnerable from inflation, the ‘Pradhan Mantri Garib Kalyan Ann Yojana’ was launched by the government to provide free foodgrains to more than 80 crore beneficiaries.

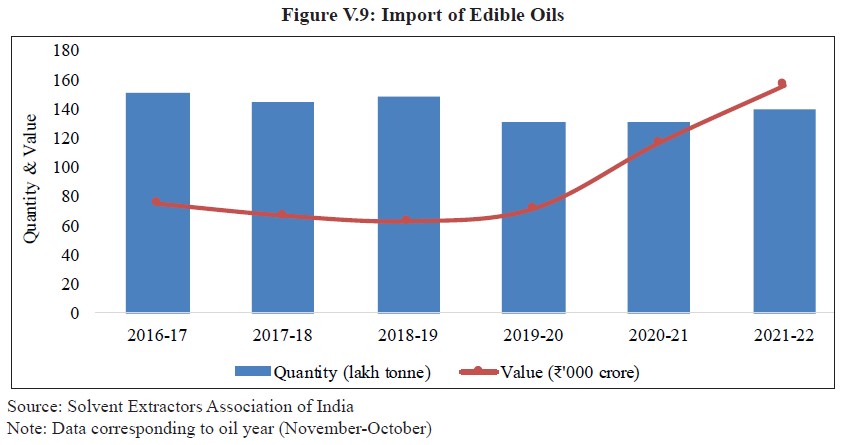

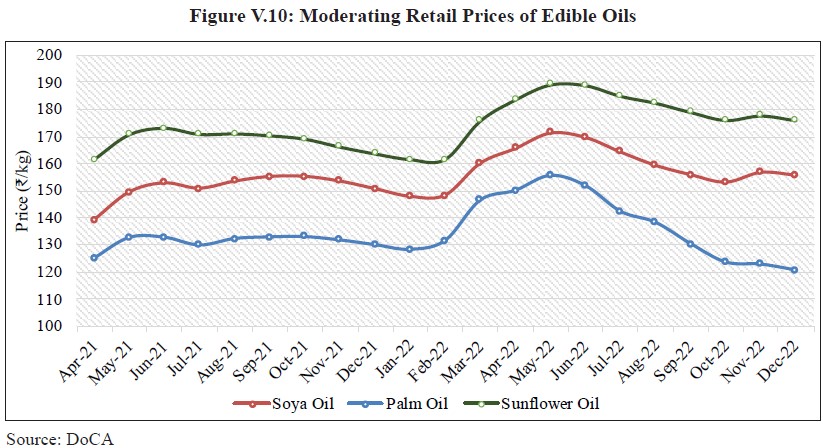

- India meets 60% of its edible oils demand through imports, making it vulnerable to international price movements.

| Box V.1: Measures to Contain Inflation in Essential Food Commodities |

| Cereals:

· The Central Government imposed an export duty of 20% on rice, brown rice, semi-milled, and wholly milled rice, except parboiled rice. |

| Pulses:

· The Central Government assigned 1.5 million tonnes of chana to various States and UTs at a discounted rate so that they could distribute it under various welfare schemes. · The states will be able to procure chana at a discount of `8 per kg over their respective issue prices. |

| Edible Oils:

· The Central Government directed leading Edible Oil Associations to ensure a reduction in the maximum retail price of edible oils by Rs 15/ litre with immediate effect. · This would lead to an increase in the import bill, but it will lower the prices of Edible Oils. |

Geographical distribution of inflation:

- Rural-Urban Inflation Differential has Declined: Rural inflation has remained above its urban counterpart in the current fiscal year, reversing the trend seen during the pandemic years.

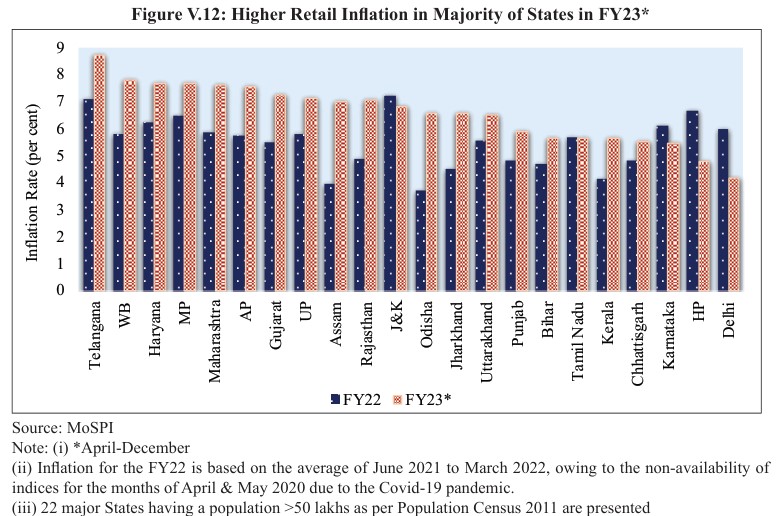

- The majority of the States/UTs have Higher Rural Inflation than Urban Inflation: CPI-C inflation increased in most of the states in FY23 compared to FY22.

Domestic Wholesale Price Inflation

- Wholesale Price Inflation(WPI) – based inflation was low during the Covid-19 pandemic, but it started to increase in the post-pandemic period as economic activities resumed.

- WPI remained elevated to double-digits till mid-2022 due to the Global Supply Chain Disruption.

- Part of it could be attributed to food inflation, which was mainly attributed to the global supply chain disruption by the Russia-Ukraine conflict.

- In comparison to FY22, core inflation remained lower in FY23.

| Measures to Contain Inflation in Input Prices |

| Fuel Prices:

· The Central Government has made several interventions by calibrating the excise duties on diesel and petrol. |

| Plastic products:

· The import duty on the import of raw materials used in the plastic industry has been contracted to lower the cost of domestic manufacturing. |

| Steel:

· The import duty on significant inputs – ferronickel, cooking coal and PCI coal has been cut from 2.5% to zero. Further, the duty on coke and semi-coke has been slashed from 5% to zero. |

| Cotton:

· The government forego customs duty on cotton imports until September 2022 to benefit the textile industry and lower prices for consumers. |

| Diamonds and gemstones:

· In Budget 2022-2023, duty on the simply sawn diamond was reduced to nil, and on cut-and-polished diamonds and gemstones, it was reduced to 5%. |

| Chemical products:

· Customs duty on critical chemicals like methanol, acetic acid and heavy feedstocks for petroleum refining was reduced in the Budget 2022-23. |

Fuel Price Inflation

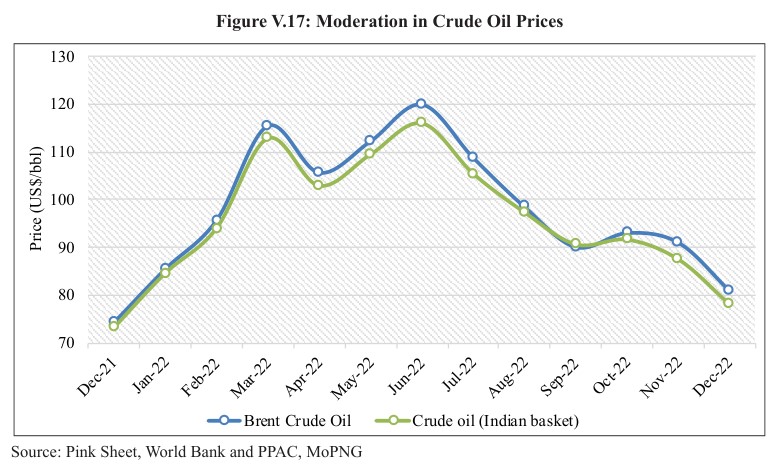

- The inflation in WPI ‘fuel and power’ was usually driven by high international crude oil prices in FY22 and FY23,

- The price of the Indian basket of crude oil stayed in the range of US$20-65/bbl during FY21 due to lower global demand because of Covid-19-induced restrictions.

- After that, prices started surging on account of unprecedented cuts in crude oil supply by OPEC and other oil-producing countries.

- A dip in central excise duty on petrol and diesel and a low VAT by the State Governments maintained a reasonable retail selling price of petrol and diesel in India.

Convergence of WPI and CPI Inflation

- Two factors mainly drove the convergence between the CPI and WPI indices.

- A cooling in inflation of merchandise such as iron, cotton, crude oil, and aluminium led to a dip in WPI.

- CPI inflated due to an increase in the prices of services.

- Falling Inflationary Expectations

- Inflationary expectations are crucial in charting the course of inflation.

- Businesses and household inflation expectations, too, have moderated.

- Monetary Policy Measures for Price stability: RBI’s Monetary Policy Committee tumid the policy repo rate under the liquidity adjustment facility by 2.25 % from 4.0 % to 6.25% between May and December 2022.

| How is the Current Inflation Different from the 1970s? |

| · Recent oil price rises are proportionally smaller than the 1970s crisis.

· Commodity supply disruptions have played a lesser role in recent price increases. · Today, the Central banks of most countries have much clearer and more robust institutional frameworks to maintain price stability. · Finally, the 1973 crisis occurred along with the Bretton Woods managed exchange rate regime collapse. In the 1970s, instruments of monetary policy and their goals were poorly defined in many countries. |

Recovery in the Housing Sector after the Pandemic

| Housing Price Indices (HPI): The National Housing Bank (NHB) publishes two Housing Price Indices (HPI), namely ‘HPI assessment price’ and ‘HPI market price quarterly’. FY18 is taken as the base year for the calculation of HPI.

|

- Monitoring housing prices is essential for achieving the objectives of price stability, financial stability, and growth.

- Of the 50 cities covered under the HPI, 43 saw an increase in the index, whereas 7 cities showed an annual decline.

Pharmaceutical Sectors

- The regulation of the prices of drugs is based on the National Pharmaceuticals Pricing Policy, 2012.

- National Pharmaceuticals Pricing Authority set the National List of Essential Medicines in 2015.

- The Ministry of Health and Family Welfare promulgated NLEM 2022. In addition, a revised Schedule I of Drugs (Prices Control) Order (DPCO) was notified by the Department of Pharmaceuticals, incorporating NLEM,2022.

- Pradhan Mantri Bhartiya Janaushadhi Pariyojana was introduced to make affordable quality generic medicines.

Conclusion

Both WPI and CPI-C have fallen below 6%. The inflation in FY24 must be a lot less challenging than it has been this year. However, the inflation challenge cannot be taken lightly. The Economic Survey expects that the monetary and fiscal authorities will be as proactive and vigilant as they have been this year.