Chapter 9: Industry Steady: Recovery

Synopsis

The Indian industry is central to the Indian economy, contributing to about 30% of the total GVA. However, in the last three years, the Indian industries have faced a set of challenges, including the Covid-19 pandemic and the Russia-Ukraine war, due to which the input prices mounted, disrupting the supply chain.

However, the Indian industry stayed afoot due to a domestic demand stimulus, a strong export performance, healthier corporate balance sheets and an increase in the private investments triggered by the augmented Capex of the central government.

But in the early FY23, some factors like persistent inflation and rising interest rates in the advanced economies dragged down export demand leading to a decline in the export performance of the Indian industries.

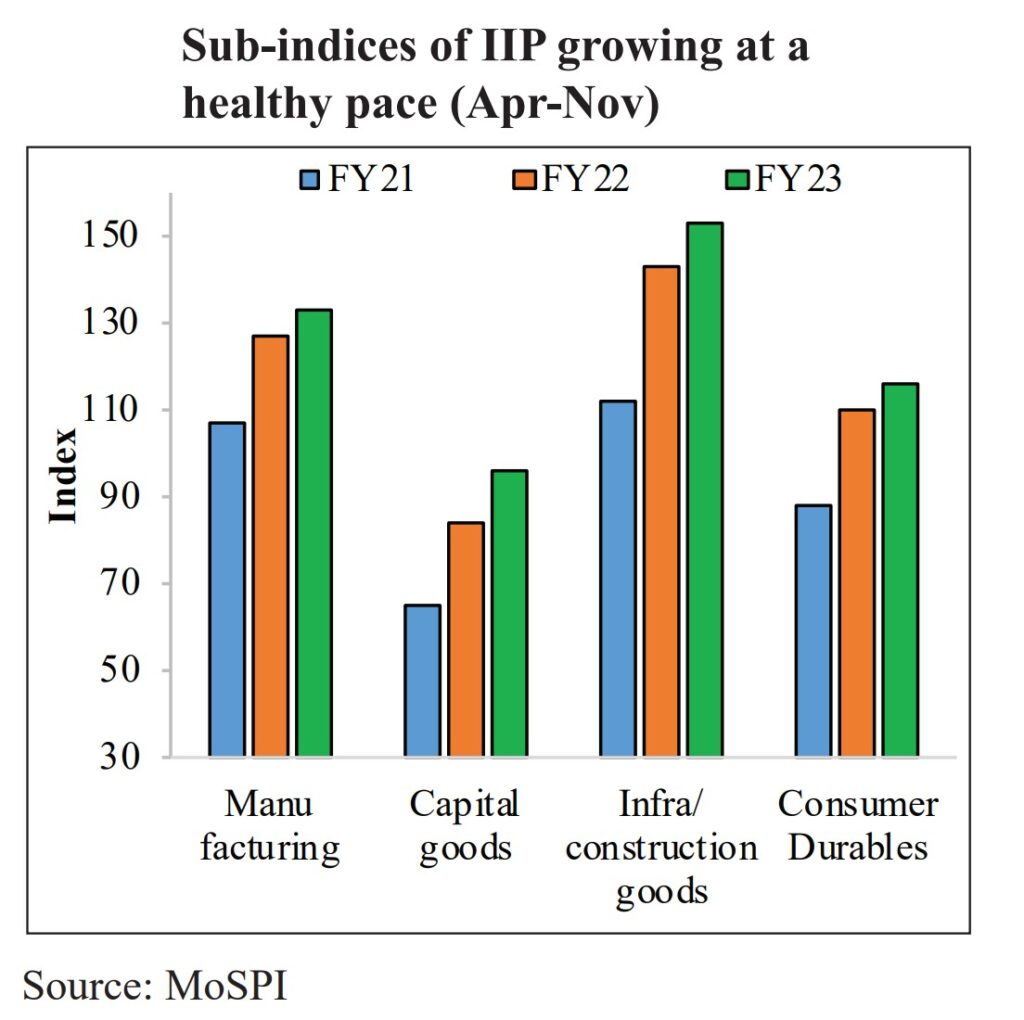

Supply response: The expansion phase of the industry has been evident in the favourable number of the Index of Industrial Production (IIP). But such growth has been uneven across various categories, with industries like automobiles and electronics registering impressive performances. At the same time, sectors like textiles showed lukewarm growth due to slowing global output and weak global demand for these products.

Bank Credits: Upswing in the bank credit has further aided the recovery and growth of the industries. There was a significant credit offtake by the MSMEs driven by the Emergency Credit Linked Guarantee Scheme (ECLGS). The larger industries have also raised their credit offtake from the beginning of FY23 to reduce the pace of capital raising from volatile debt and equity markets.

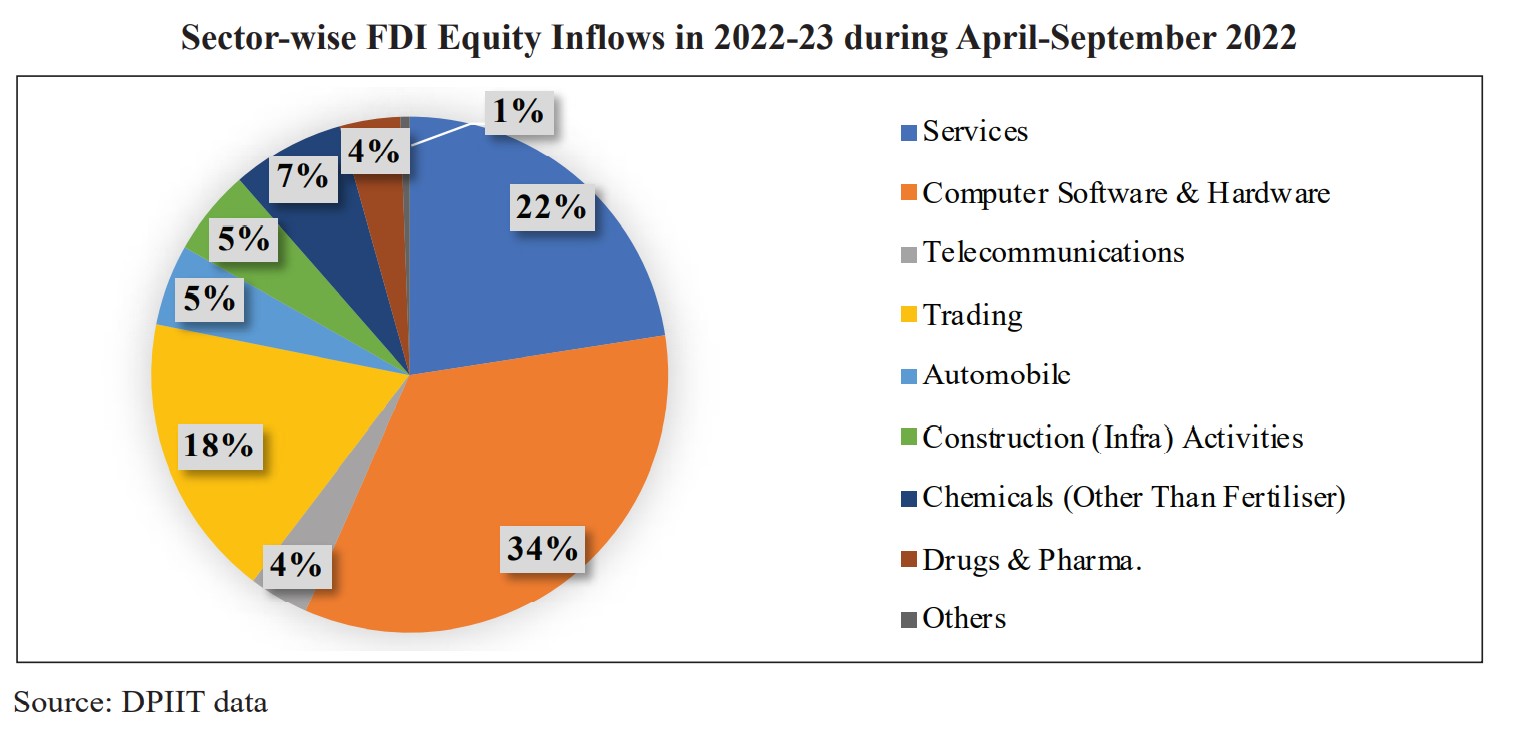

Foreign Investments: Foreign Direct Investments (FDI) in the manufacturing sector moderated in the first half of FY23. It remained above the pre-pandemic levels, driven by structural reforms and measures improving the ease of doing business.

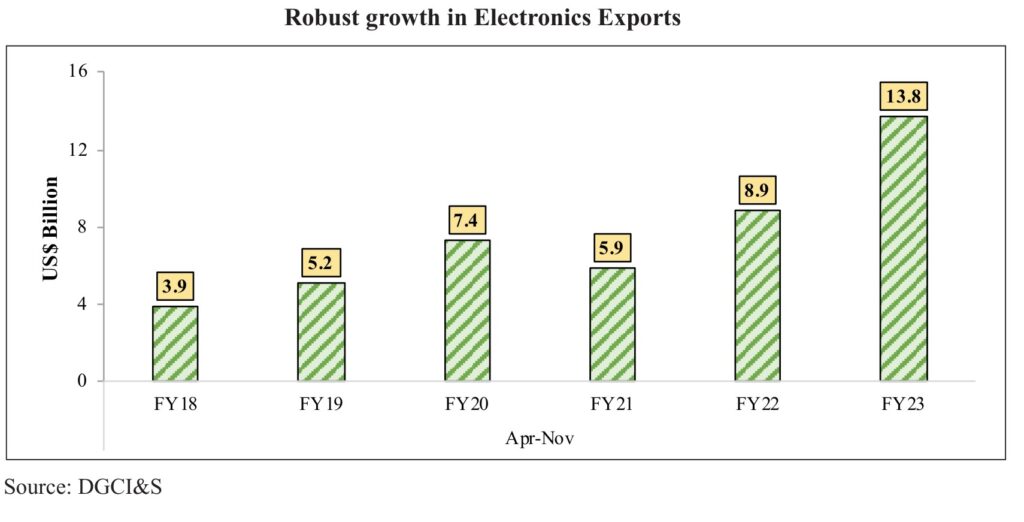

India’s Electronics industry: The Indian electronics sector is driven by mobile phones, consumer electronics, and industrial electronics. India has become the 2nd largest mobile manufacturer globally. Aided by improved communication services, the electronics sector has the potential to enhance productivity, efficient service delivery and social transformation.

India’s Pharmaceutical Industry: Globally, India ranks 3rd in the production of pharma products by volume and 14th by value. India is the largest provider of generic medicines globally, with a 20% share of the global market by volume. In vaccine manufacturing, India has a market share of 60%. The pharma exports and cumulative FDI in pharma have been upbeat during the pandemic.

The Make in India initiative is complemented by the Production Linked Incentive (PLI) scheme across 14 categories, aiming to make India a global manufacturing hub by facilitating investments, fostering innovation, building world-class infrastructure, and increasing domestic manufacturing capacities that will meet domestic and global needs and also build resilience against supply chain shocks.

Introduction

Importance of Indian Industry

- Accounts for 31% of the GDP (FY12-FY21)

- Employs 12.1 crore people.

- Has various direct and indirect linkages with other sectors.

- Meets domestic demands and reduces reliance on imports.

- Produces multiplier effects, having a bearing on employment growth. E.g., Textile and construction have high employment elasticities.

- Spurs growth in the services sectors such as banking, insurance, logistics etc.

Performance of the industrial sector

Industrial growth rates: 10.3% in FY22 and 4.1% in FY23. The decline has been on account of the following:

- Input cost-push pressures.

- Supply-chain disruptions.

- China’s lockdown impacted the availability of essential inputs.

- Slowing global economy.

Demand Stimulus to Industrial Growth

Strong domestic demand

- The pent-up Indian consumers demand post-pandemic has been sustained in FY23 despite global challenges such as the Russian-Ukraine conflict, which have caused higher input costs for the Indian industries and, subsequently, a sticky but non-rising core retail inflation.

- The main reasons for the sustained demand are the easing of the local weather extremities and the effectiveness of the government’s intervention to restrict prices that have brought down the non-core retail inflation.

- Thus, consumer demand induced an industrial recovery despite the global headwinds.

Strong external demand

- Solid external demand supported Indian exports in FY22, which continued till the first half of FY23. As a result, India’s export as a share of GDP was highest since FY16 in the first half of FY23.

- Later, the strength of the export stimulus waned due to persistently high inflation and rising interest rates in the advanced economies.

- However, strong domestic consumption growth and investment revival hold a better prospect for Indian industries.

Investment Demand

- A sharp increase in the Capex of the government in FY22 and FY23 has served as a powerful stimulus to industrial growth. The public investments also created a virtuous cycle by crowding-in private investments.

- Pent-up consumption demand, export stimulus and strengthening of the corporate balance sheets from deleveraging were already encouraging private investments.

- Another driving factor for private investments was greater profitability during FY21-H2 due to lower inflation keeping the input cost from rising and reduced overheads from the restricted mobility.

- Long-term measures: Following long-term efforts have enriched the investment climate:

- Slashing of the corporate tax rate.

- Implementation of ECLGS for MSMEs.

- Maturing digital infrastructure and easy and cheap access to

- Well-capitalized banks were ready and willing to lend, facilitated by an effective law, the Insolvency and Bankruptcy Code.

Thus, the banks and the corporates are well-placed to maintain an upturn in the credit-investment cycle in the medium term.

- Statistics:

- The first half of FY23 recorded the highest Gross Fixed Capital Formation (GFCF) in GDP among all half-years since FY15.

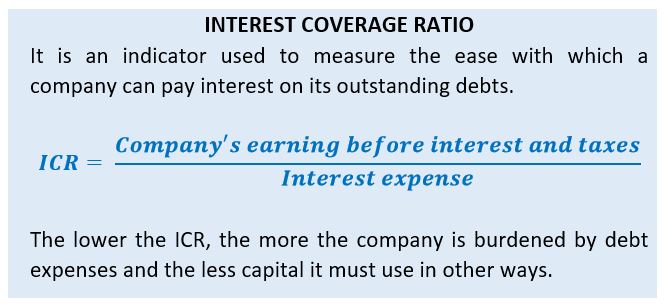

- During FY23-H1, the interest coverage ratio was 5, higher than its five-year average of 3. Simultaneously, the debt-equity ratio declined from 0.8 to 0.4.

Supply Response of Industry

- The supply response of the industry to the demand has been robust since FY22-H2.

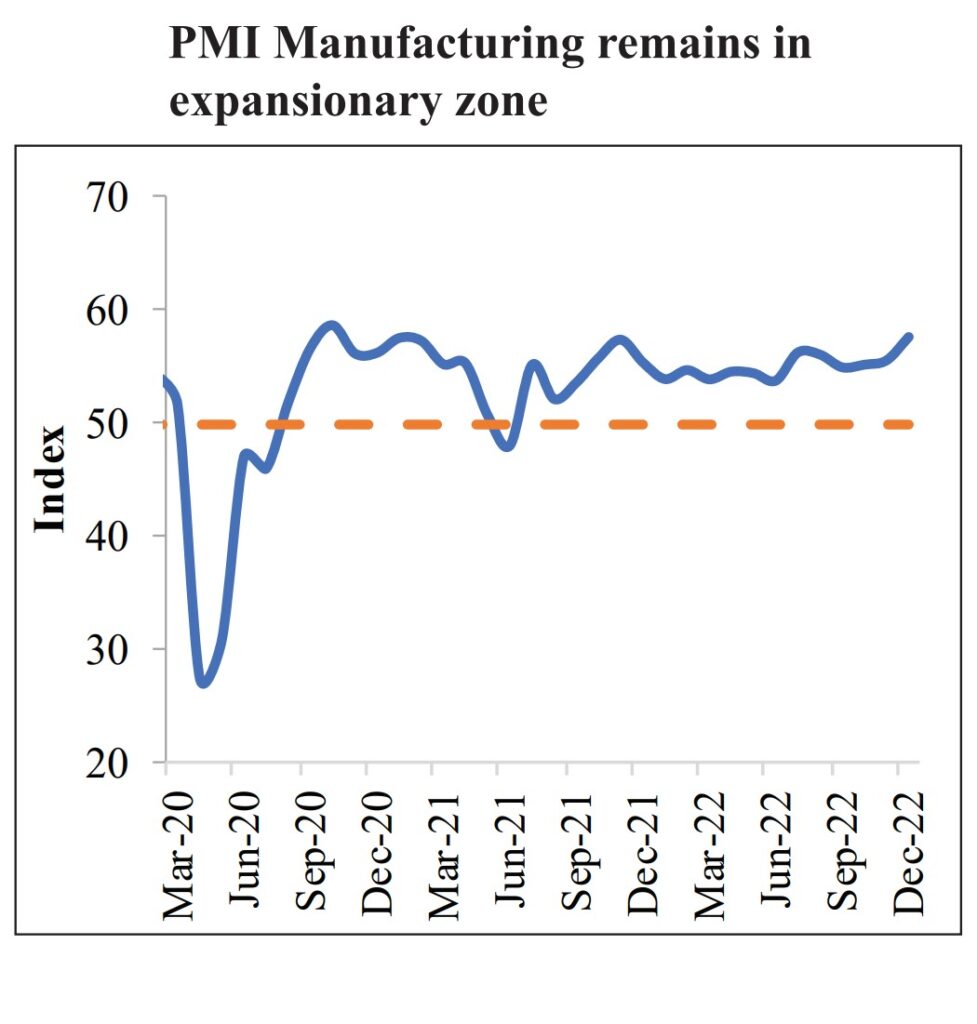

- The PMI-Manufacturing (Dec 2022) was in an expansionary zone, easing input cost pressures, improving supplier delivery times, robust export orders and future output. Moreover, there is an easing in the momentum of the output prices due to the moderation of the input cost inflation. However, the export prospects remain bleak due to subdued global demand.

- The robust growth in the production of capital goods and infrastructure goods (see “consumer durables” sub-index of the IIP) also indicate the next FY was good for private investment.

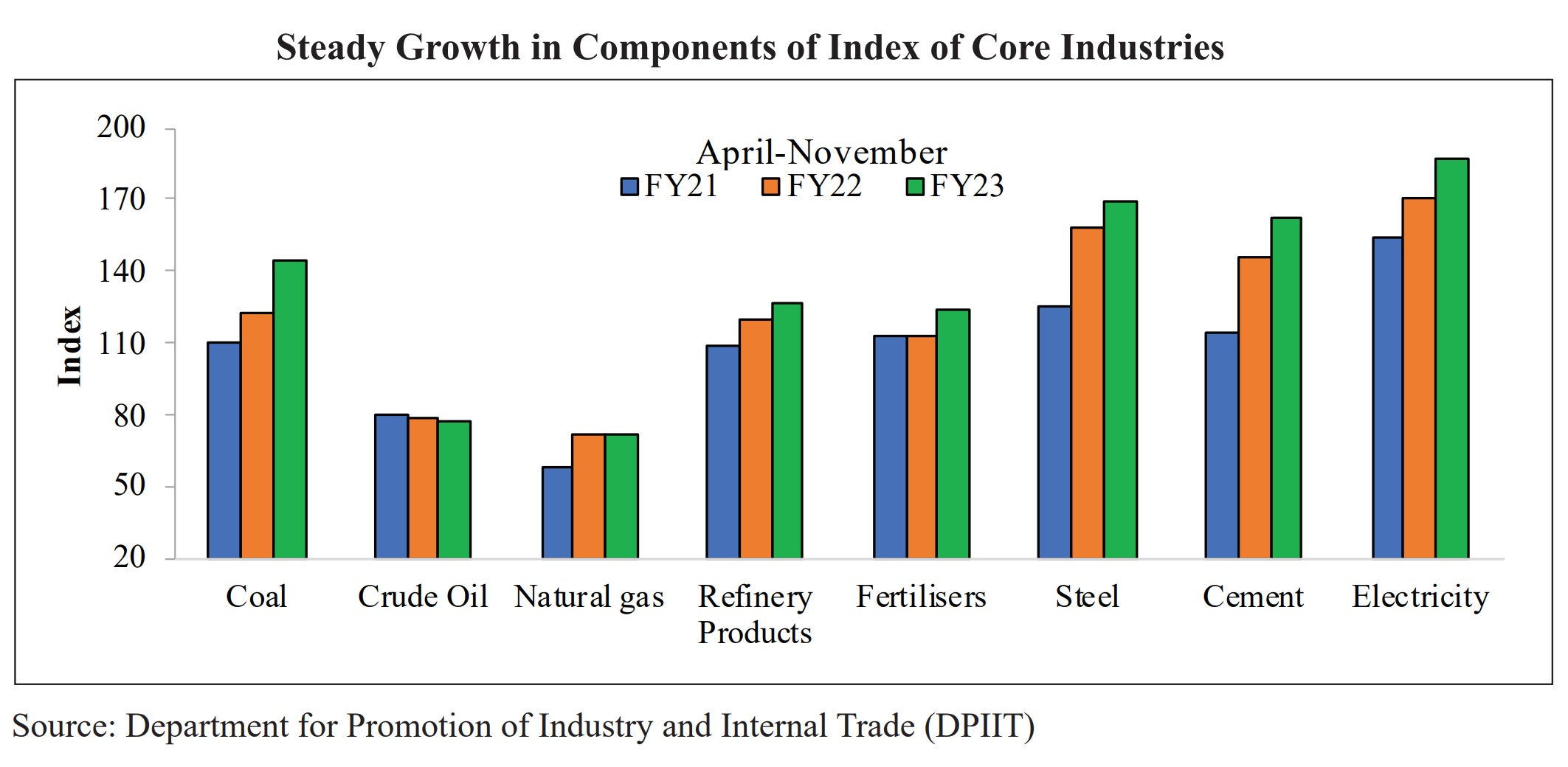

- The growth of the core industries is also steady, reflecting a broad momentum in industrial activity.

- The PMI-Manufacturing (Dec 2022) was in an expansionary zone, easing input cost pressures, improving supplier delivery times, robust export orders and future output. Moreover, there is an easing in the momentum of the output prices due to the moderation of the input cost inflation. However, the export prospects remain bleak due to subdued global demand.

- Restraints on the manufacturing output:

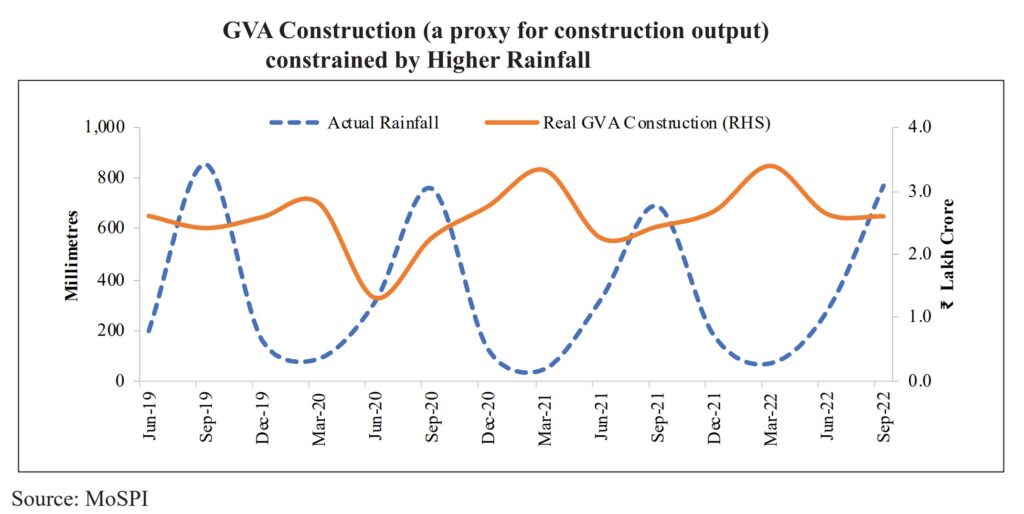

- Effects of seasonality on industrial growth:

- Higher rainfall restrained the growth of the mining and quarrying, and construction sectors.

- Higher rainfall also cooled the temperatures causing a dip in the electricity demand.

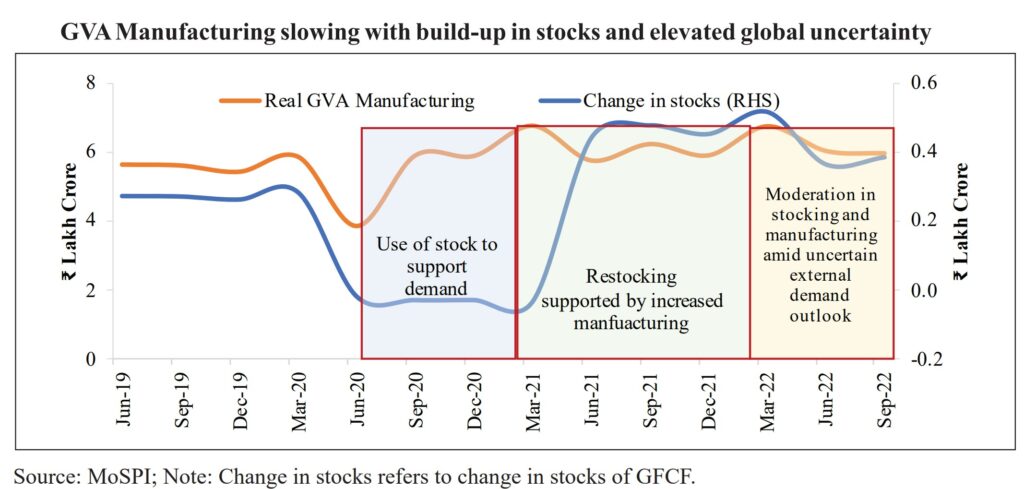

- Stock inventory and the manufacturing output

- A build-up of stocks can help meet current demands and allow manufacturing to slow its pace. And when the stocks start shrinking, manufacturing output must meet the current demand and replenish the stocks before the next cycle.

- In FY23-Q2, the build-up of stocks restrained the manufacturing output.

- Effects of seasonality on industrial growth:

- Uneven Growth Across Sectors:

- Not all manufacturing categories have shown robust growth.

- Highly performing categories:

- Motor vehicles – due to the easing of chip shortage and an uptick in demands

- Computer, electronics, and optical products – due to policies of the government aimed at promoting India as a semiconductor manufacturing hub.

- Production of crude and refined petroleum

- Chemicals and chemical products include caustic soda, soda ash, fertilizers, and petroleum products. These have sustained increasing exports and the growth momentum of the agricultural sector.

- Low-performing categories:

- Textiles, apparel, and leather – due to slowing global output and demand.

- Pharmaceuticals – due to unfavourable base effect and the waning of the pandemic.

Robust Growth in Bank Credits to Industry

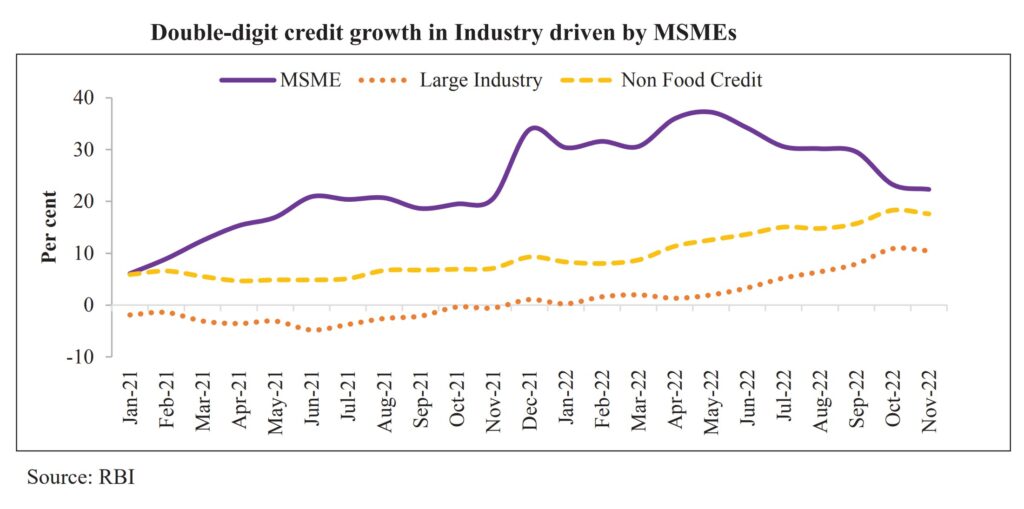

- Bank loan growth has kept pace with the industrial expansion, and a sequential upswing has been visible since January 2022.

- One notable aspect has been the increase in credit to the MSMEs, which has been prompted by the following:

- The ECLGS Scheme.

- Rebounding consumption levels.

- The increase in the pace of credit offtake by large companies began at the beginning of FY23 due to the following:

- Narrowing of the spread between the corporate bond yields and the marginal costs of funds-based lending rate (MCLR).

- Persisting volatility in the corporate market, while the banks offered stable and predictable lending rates.

- Robust growth in the credit demand with rising capacity utilization and investments in manufacturing underscores businesses’ optimism regarding future demand.

- Statistics:

- The textile segment showed no increase in credit offtake.

- Segments with steady credit appetite include:

- Petroleum, coal products and nuclear fuels,

- Rubber, plastic and their products, and

- Engineering

- The improvement in credit growth to the cement and construction industries over the previous year shows a better prognosis for the construction sector.

Resilient FDI inflow in Manufacturing Sector

FDI inflows to the Indian manufacturing sector jumped drastically from US$ 12.1 billion in FY21 to US$ 21.3 billion in FY22 due to the pandemic-induced expansionary policies of the advanced economies. But, this effect subsided as the coordinated monetary tightening world-over kicked in.

The government has been undertaking several steps to boost the FDI inflow in India:

- Raising of FDI limits: FDI up to 100% is permitted through automatic routes in most sectors.

| FDI Limit | Route | Sectors |

| 100% | Automatic route | · Sale of coal, and coal mining activities, including associated processing infrastructure |

| 100% | Verification by IRDAI | · Intermediaries or Insurance Intermediaries, including insurance brokers, reinsurance brokers, insurance consultants, corporate agents, 3rd-party administrators, Surveyors and Loss Assessors |

| 26% | Government route | · Uploading/ streaming of News & Current Affairs through Digital Media. |

- Removed many regulatory barriers

- Foreign Investment Promotion Board (FIPB) was abolished in May 2017. The concerned Ministries/ Departments and DPIIT is now the nodal department for facilitating the process.

- Development of infrastructure.

- Improving the business environment

- Foreign Investment Facilitation Portal (FIF Portal) – A revamped portal that will serve as the online single-point interface of the government of India for investors to facilitate FDI. In addition, the FIF Portal has been integrated with the National Single Window System (NSWS).

- Transformative FDI reforms across sectors such as Defence, Pension, e-commerce activities etc.

- The government amended the FDI policy to curb the opportunistic takeover/acquisition of Indian companies due to the COVID-19 pandemic by investors who are citizens of India’s neighbouring countries.

Industry Groups and their Challenges

MSME

| Performance | 1. MSMEs’ share in overall GVA has been increasing marginally since FY17. But the pandemic caused this share to fall.

2. MSMEs’ share in the GVA of the manufacturing sector has been steadily declining since FY17. 3. Expansion in credit (discussed earlier) due to the ECLGS scheme. o The category of MSME borrowers who used ECLGS had a lower NPA rate in banks than those who did not use the programme. Overall, the MSMEs recovered from the pandemic shock (evident from the increased GST collections from MSMEs) because of the several initiatives that the government took. |

| Steps taken | 1. Modification of the definition of MSMEs

2. Provision of ₹20,000 crores subordinate debt for stressed MSMEs. 3. ₹50,000 crore equity infusion through Self Reliant India fund. 4. Waiving of the global tender requirement for procurement of up to ₹200 crores. 5. Launching the Udyam portal for MSME registration, a paperless, zero-cost registration portal. 6. Samadhaan Portal: To monitor the MSME sector’s outstanding dues and help them resolve their cashflow difficulties. o To facilitate the discounting of MSMEs’ trade receivables through various lenders, the government has also directed CPSEs and all businesses with a turnover of at least 200 crores to sign up for the Trade Receivables Discounting System (TReDS) platform. 7. CHAMPIONS was launched as a single-window grievance redressal portal for MSMEs. 8. ‘Raising and Accelerating MSME Performance’ scheme (RAMP) was launched in FY23. o Supported by the World Bank. o Aim = To strengthen institutions and governance at the Centre and the State to:

o It will be implemented for 5 years. 9. ECLGS scheme |

Electronics Industry

| Performance | • The current value of the domestic electronics industry is US$118 billion. India targets to reach US$300 billion worth of electronics manufacturing and US$ 120 billion in exports by FY26.

• The improved manufacturing performance and exports over the five years indicate that India is on the right track towards achieving this target. • Major drivers: 1. Mobile phones: India has become the 2nd largest mobile phone manufacturer globally. 2. Consumer electronics, and 3. Industrial electronics – Improved digitization and robotics in this sector are the reasons behind the growth of this sector. The emphasis on smart cities and the Internet of Things (IoT) are other potential drivers of this industry. |

| Steps taken | 1. PLI Scheme for Large Scale Electronics Manufacturing

o Some major global and domestic players in electronics manufacturing services have already joined the scheme, which is expected to help many more domestic players attain economies of scale in production. 2. PLI scheme for IT hardware 3. Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) 4. Programme for Development of Semiconductors and Display Manufacturing Ecosystem in India. |

| Expected outcomes | 1. Boost India’s manufacturing capacity

2. Reduce import dependence, 3. Contribute to achieving India’s aspiration of becoming a significant player in global supply chains. |

Various incentives under Semiconductor Scheme

The government aims to attract investments for developing a semiconductor manufacturing ecosystem. Towards this end, the following schemes have been launched:

- A comprehensive programme with an outlay of ₹76,000 crores (approx. US$ 10 billion) was approved by the Government of India in September 2022. It includes:

| Scheme for | Financial support (as a share of the firm’s Capex) | R&D Support (as a share of the scheme outlay) |

| Setting up of Semiconductor Fabs in India | 50% | Up to 2.5% |

| Setting up Display Fabs | 50% | Up to 2.5% |

| Setting up of Compound Semiconductors / Silicon Photonics / Sensors Fab and Semiconductor ATMP /OSAT facilities | 50% | Up to 2.5% |

- Design Linked-Incentive (DLI) scheme:

- Objectives:

- Nurturing and facilitating domestic companies for semiconductor design.

- Achieving significant indigenization of semiconductor products and IPs deployed across the country.

- Strengthening the infrastructure for the design.

- Supports under the scheme: Financial support of 50% of eligible expenditure on the design, subject to a ceiling of ₹15 crores per applicant and a deployment-linked incentive of 4% to 6% of net sales achieved over 5 years, subject to a ceiling of ₹30 crores per applicant.

- Objectives:

These initiatives have attracted the interest of global and domestic players in the semiconductor sector. Ex: A semiconductor consortium based in Israel will be investing ₹ 22,900 crores in Karnataka to set up India’s first chip-making plant. In addition, domestic firms like Vedanta and Tata have plans to build semiconductor fabs in the country.

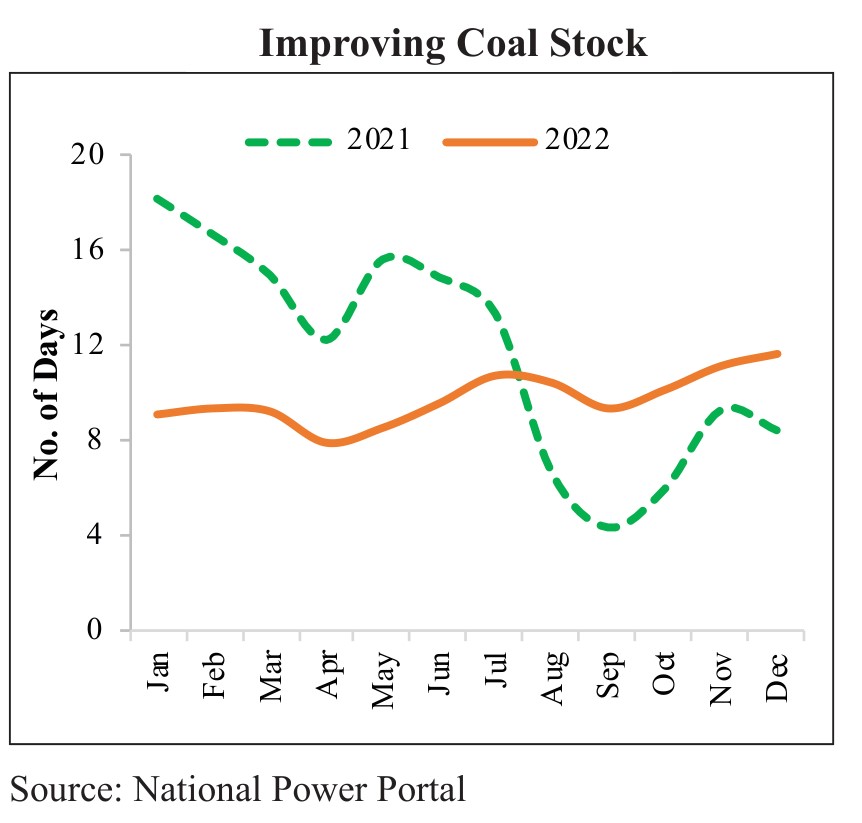

Coal Industry

| Coal shortage | • Availability of coal for thermal-based power generation was of prime concern in the early part of FY23, the reasons being:

1. A resurgence in economic activity 2. Heat waves from early March to mid-May of 2022 led to increased power demands in the country. 3. Rising international coal prices are causing curtailed coal imports. • Several steps were taken to meet the high demand-supply gap for coal: 1. All the generators needed to import coal to the extent of 10% of their requirements (as against 4% earlier). 2. Imported coal-based plants were instructed to operate at full capacity under Section 11 of the Electricity Act 2003 (Act), with the incentive that their increased operating costs would be covered. 3. Tolling was enabled to ease the burden on the availability of railway rakes. Instead of transporting the coal too far from state generators, the tolling facility allowed states to shift their allotted coal to private generators close to the mines. 4. Commercial banks and the Rural Electrification Corporation (REC)/Power Finance Corporation (PFC) were urged to help power plants access more working finance. • These measures improved the coal stocks and catered to the excess energy demand. |

| Steps taken to achieve self-reliance in coal production | 1. Private participation in coal production

2. FDI under the automatic route. 3. Auctioning of coal blocks for commercial production. 4. Expansion of existing mines and opening of new mines. 5. Greater use of mass production technology in mining. 6. Mechanization of loading. 7. Development of evacuation infrastructure etc. |

| Expected outcomes | • Achieve a 6-7% growth rate for the coal industry.

• Achieve a production level of 1 billion tonnes by FY26 and about 1.5 billion tonnes by 2030. • Improve system capacity utilization from about 80% to above 90%. |

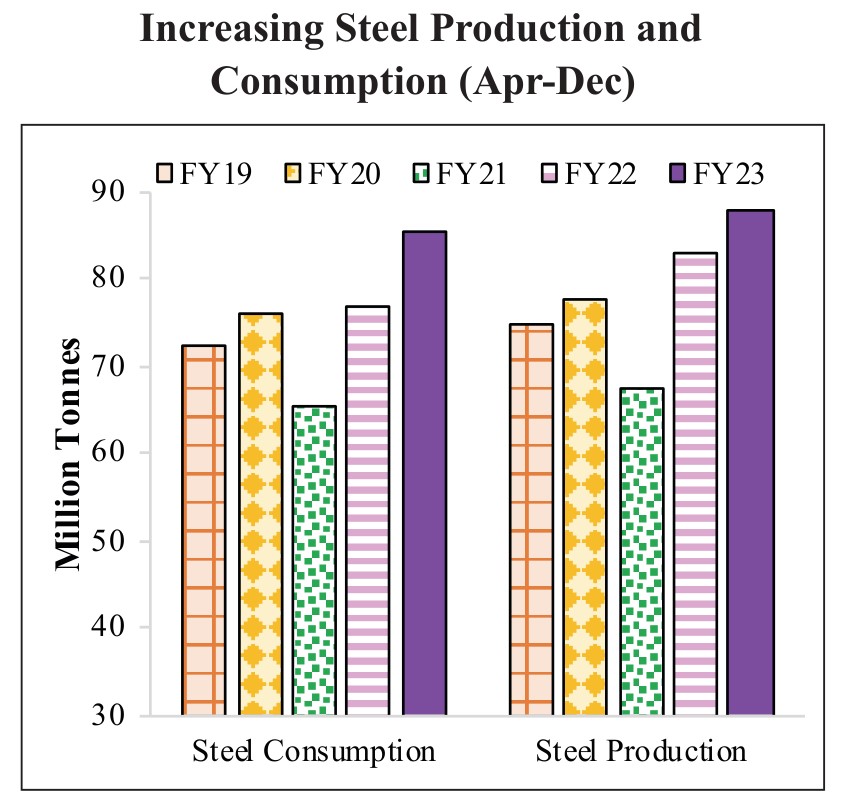

Steel industry

| Performance of the steel sector | • India is the 2nd largest crude steel producer in the world.

• It has recorded 11% growth in consumption, bolstered by a pick-up in the infrastructure sector and construction activity significantly driven by increased government Capex. • Other driving factors include: (1) domestic steel makers’ stable credit profiles, (2) deleveraged balance sheets, (3) robust cash accrual support continues to support their capex. (4) Healthy demand from the automobile sector. |

| Steps taken | • PLI Scheme for speciality steel. |

| Immediate challenges | Steel exports may remain subdued due to the global slowdown. |

Textile industry

| Performance of the Textile industry | • It is a major employment generator, including a large number of women and the rural population.

• Textile exports have declined in FY23, induced by the global slowdown after the pandemic. |

| Steps taken | • PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks.

o Objectives: To develop integrated large-scale and modern industrial infrastructure facilities for the entire value chain of the textile industry o 7 PM MITRA Parks have been established. o Benefits:

• Textile PLI Scheme o Aim: To promote investments and increase the production of Man-Made Fibre (MMF) Apparel, MMF Fabrics and Products of Technical Textiles. |

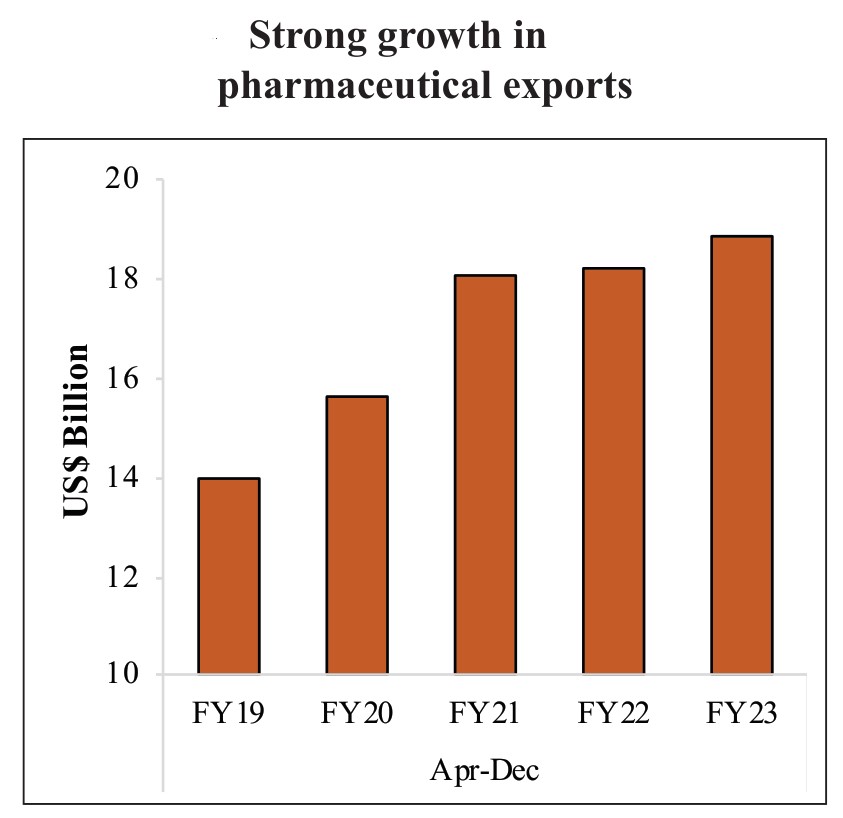

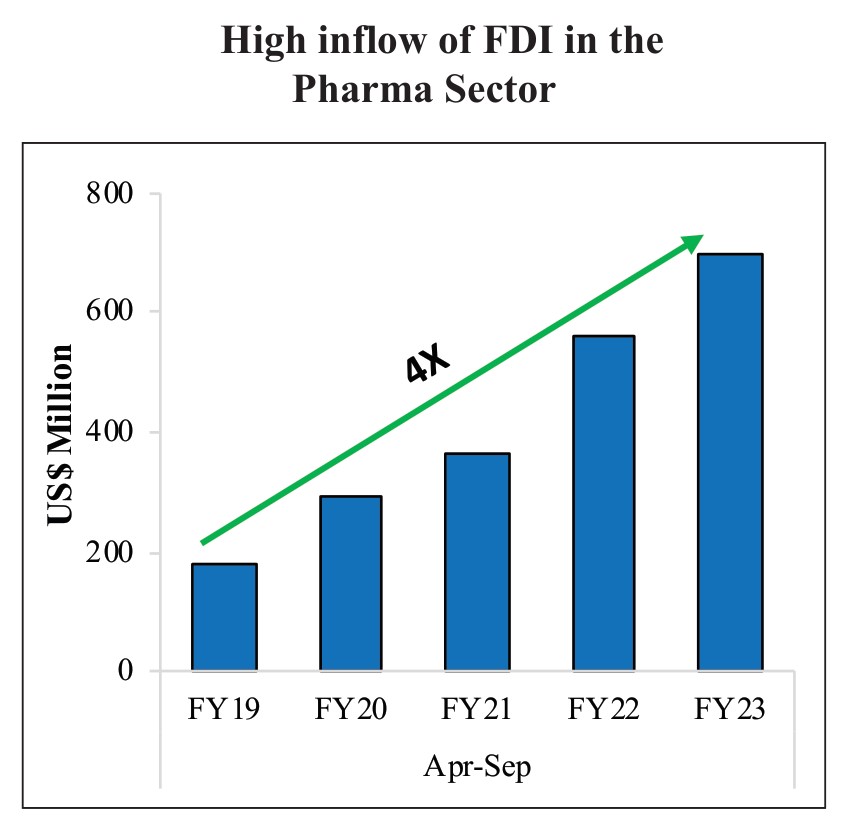

Pharmaceuticals industry

| Performance | • India’s pharmaceutical industry occupies a prominent role in the global pharmaceutical industry.

• Size of India’s domestic pharmaceutical market: o US$ 41 billion in 2021 o Likely to grow to US$ 65 billion by 2024. o Expected to reach US$ 130 billion by 2030. • India’s rank in the world o 3rd in the production of pharma products by volume o 1st as the provider of generic medicines, occupying a 20% share in global supply by volume. o 1st in vaccine manufacturing (with a market share of 60%) • Exports growth: o 24% in FY21, driven by Covid-19-induced demand for critical drugs and other supplies. o The growth was sustained in FY22 despite the global trade disruptions and drop in demand for Covid-19-related treatments. • FDI in the pharma sector: It has nearly quadrupled between FY19 to FY23, supported by investor-friendly policies and a positive outlook for the industry. |

| Steps taken | 1) Three PLI Schemes to boost manufacturing:

a) PLI Scheme for Critical KSMs/DIs/APIs b) PLI Scheme Medical Devices c) PLI Scheme for Pharmaceuticals 2) Measures to improve the infrastructural facilities of the pharma sector. a) Strengthening the Pharmaceutical Industry (SPI) scheme. Its objectives are:

|

Automobile industry

| Performance | • India has recently become the 3rd largest automobile market (surpassing Japan and Germany in sales).

• Contribution to the economy: o 7.1% to the overall GDP o 49% to the manufacturing GDP. • Electric vehicles (EVs): The automotive sector has a critical role to play in the green transition: o Expected CAGR of the domestic EV market is 49% between 2022 and 2030. o Expected sales by 2030 = 1 crore units. o Create 5 crore direct and indirect jobs by 2030.

|

| Steps taken | • For nurturing EV growth:

a) Consumption enhancing initiatives: FAME-I and FAME-II b) PLI Schemes for:

|

| Challenges | • Near-term hurdles:

a) Higher borrowing costs. b) Tempering global demand. • Structural issues a) Increase in long-term 3rd-party vehicle insurance premiums, mainly affecting the 2-wheeler segment sales in the last 10 years. |

India’s Prospects as a Key Player in the Global Value Chain

What have been the threats to global supply chain shocks?

- US-China trade war.

- The Covid-19 pandemic.

- The war in Ukraine.

- Rising protectionism.

How can the current changes around the supply chains be an opportunity for India?

- Countries world-over are reformulating their strategies for manufacturing and supply chains. This shift is taking at a rapid pace and presents itself as a unique opportunity for India to become a global manufacturing hub this decade.

- The 3 primary assets to capitalize on this unique opportunity are:

- The potential for significant domestic demand,

- the Governments’ thrust on the manufacturing sector, and

- India’s rich demographic dividend.

- Another factor that can help India tap this opportunity is the gradual transition to Industry 4.0 for increased efficiency and production levels.

What steps has the government taken towards making India a global manufacturing hub?

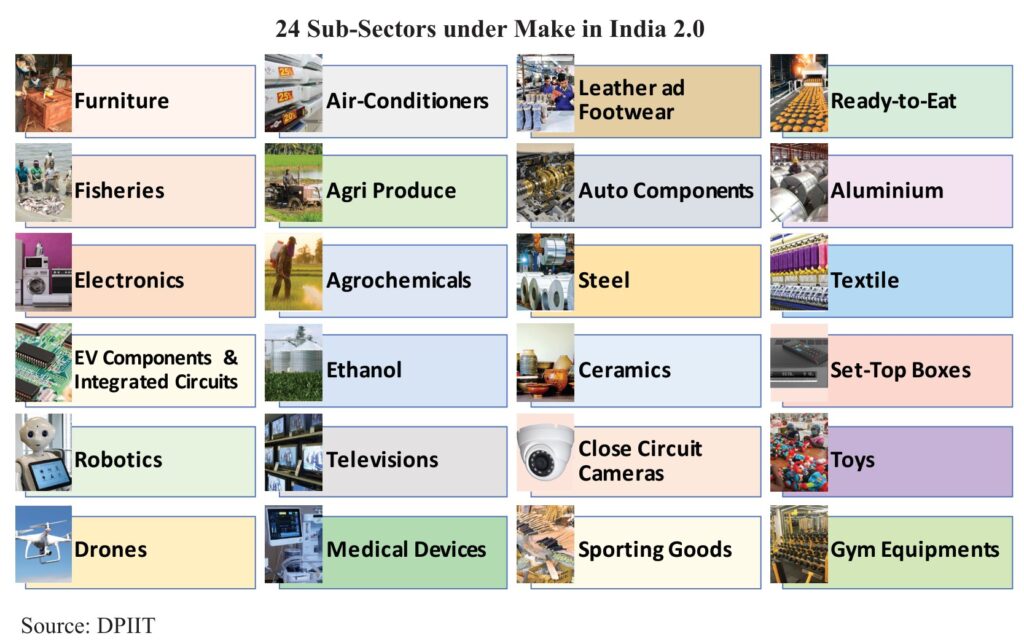

- Launched Make in India 1.0 and 2.0 – for facilitating investment, fostering innovation, and building world-class infrastructure.

- PLI Schemes

- Structural reforms for Ease of Doing Business

- Policy pushes towards Industry 4.0

Make in India 2.0

- Under Make in India 2.0, 27 sectors (15 manufacturing and 12 services sectors) have been focused for increased India’s integration into the global value chain.

- 24 sub-sectors of the 27 sectors have been selected on various parameters:

- Indian industries’ strengths and competitive edge

- The need for import substitution

- The potential for export and

- Increased employability.

- The efforts to boost growth in the 24 sub-sectors would be made holistically and co-ordinately.

| Importance of the Shipbuilding Industry for Achieving Self-Reliance and Promoting Make in India |

| 1. Strategically crucial due to its role in energy security, national defence and the development of the heavy engineering industry. 2. Boost to economic growth: o With immense direct and indirect linkages with most other leading industries and its massive dependence on the infrastructure sector and the services, the sector bears the potential to increase the capacity of the manufacturing and the services sector to contribute to the national GDP. o Ex: The development of warships and submarines has provided the industry with the requisite impetus. o Thus, the shipbuilding industry strengthens our Mission of Atmanirbhar Bharat. 3. Boost to ancillary industries and MSMEs. o The shipbuilding industry can boost other ancillary industries, including steel, engineering equipment, port infrastructure, trade, and shipping services, and has the potential to create a collaborative production eco-system. o Down the line, newer opportunities are generated for smaller businesses and strengthen the supply chain networks. 4. Multiplier effects o The shipbuilding has an investment multiplier of 1.82X and an employment generation multiplier of 6.4X. o It can become a mass employer in remote, coastal and rural areas and catalyze a structural shift of the workforce from agriculture to manufacturing. 5. Important sector for indigenization o The Indian Navy’s indigenization projects have produced significant employment opportunities for MSMEs and other industries. o The investments in these projects are re-invested in the Indian economy through local sourcing requirements and other manpower services. o Ex: In constructing seven P17A ships, about 75% of the total project cost of warships is invested back into the Indian economy. 6. Reduce freight bill and forex outgo, and thereby reduce current account deficit.

|

PLI schemes

- The PLI schemes complement the Make in India 2.0. The PLI scheme focuses on self-reliance by attracting Capex worth ₹3 lakh crores over the next five years.

- Coverage: The schemes under PLI cover 14 sectors that together account for 40% of the total imports.

- Significance:

- It can enhance India’s manufacturing capex by 15-20% from FY23.

- Increased global competitiveness of Indian manufacturers.

- Attract investment in the areas of core competency and cutting-edge technology.

- Ensure efficiencies.

- Create economies of scale.

- Make India an integral part of the global value chain.

- Benefit the MSME ecosystem in the country by serving as ancillary units to large enterprises.

- Key beneficiary sectors: Bulk Drugs, Medical Devices, White Goods, Food Processing, Large-Scale Electronics Manufacturing, Pharmaceuticals, Telecom & Networking Products, and Solar-PV Modules.

- Design-led PLI: It is a new component under the PLI scheme to promote the entire value chain in telecom manufacturing and to build a robust ecosystem for 5G as part of the PLI Scheme for Telecom & Networking products.

Fostering Innovation

- Government efforts for fostering innovation:

- Support to startups at all stages covering incubation, handholding, funding, industry-academia partnership and mentorship.

- Startup India Initiative – (1) eligible companies get recognized as Startups by DPIIT to access a host of tax benefits (2) easier compliance (3) IPR fast-tracking

- National Initiative for Developing and Harnessing Innovations (NIDHI)

- Atal Innovation Mission (AIM)

- Fund of Funds for Startups (FFS) and Credit Guarantee Scheme for Startups (CGSS) for seed funding and successive credit needs.

- Strengthening the IPR regime, (1) modernizing the IP office, (2) reducing legal compliances, and (3) facilitating IP filing for startups, women entrepreneurs, small industries and others.

- Support for International Patent Protection in e&IT (SIP-eIT) Scheme ‒ encourages international patent filing by Indian MSMEs and startups

- R&D platform for technology sectors

- MeitY Startup Hub (MSH)

- Technology Incubation and Development of Entrepreneurs (TIDE 2.0)

- Outcomes:

- In the Global Innovation Index (GII) 2022, India is in the top 40 innovating counties. In GII 2015, India was ranked at place 81.

- Startups have emerged as significant job creators of the economy.

- Challenges:

- Ever-elusive funding.

- Revenue generation struggles.

- Lack of easy access to supportive infrastructure.

- The complex regulatory environment and tax structures.

|

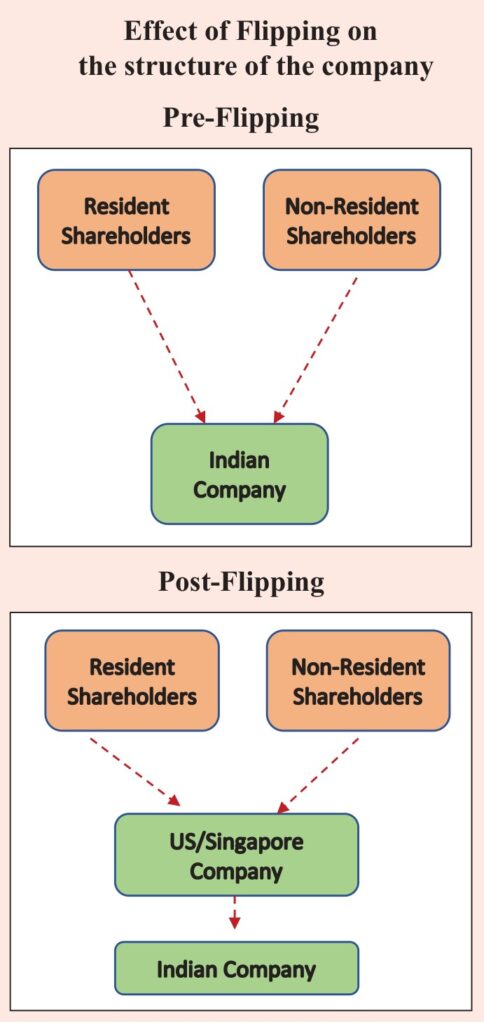

The Problem of ‘Flipping’ |

| • Many Indian companies have been moving their headquarters to foreign countries, offering favourable legal environments, taxation policies, etc. It is called ‘flipping’. • It encompasses a transfer of ownership, all the IP and the data of the Indian company to the overseas entity. As a result, the status of the Indian company is reduced to a 100% subsidiary of the foreign entity. However, the founders and investors continue to retain the ownership via the foreign entity by swapping the shares. • Flipping is more common at the early stage of Startups. • Flipping is driven by commercial, taxation and personal preferences of founders and investors: o Commercial: The major market of the company’s product being offshore. o Investor preferences:

o Better protection and enforcement of IP and tax treatment of Licensing revenue from IP. o Residential status of Founders. o Agile corporate structures. • Example: o Singapore, UAE, and Netherlands are popular holding company jurisdictions, which have tailormade their policies and tax and incentive structures to incentivize companies to store IPs and create Holding companies as Regional Headquarters. o Singapore: Dividends received from a Singaporean company/subsidiary are not taxed at the holding level. There are no withholding taxes when distributing dividends to residents or non-resident shareholders. o UAE has no withholding taxes. o The Netherlands provides participation exemptions on dividends and capital gains. These exemptions are not available in India, and any migration of existing structures to India invites capital gains tax. • However, the following factors are contributing to reversing this trend (‘Reverse-flipping’): o Relatively easy access to capital through a vibrant Private Equity/Venture Capital Ecosystem o Changes in rules regarding roundtripping. o The growing maturity of India’s capital markets • Measures needed to accelerate ‘reverse-flipping’: 1. Simplifying the process for grant of “Inter-Ministerial Board (IMB) certification” for startups. 2. Further simplification of taxation of Employee Stock Options (ESOPs). 3. Simplifying multiple layers of tax and uncertainty due to tax litigation. 4. Simplifying procedures for capital flows: Many countries, such as US and Singapore, have easier corporate laws, with lesser restrictions on the inflow and outflow of capital and treatment of Hybrid Securities. 5. Facilitating improved collaboration and partnerships with established private entities to develop best practices and state-of-the-art startup mentorship platforms. 6. Exploring the incubation and funding landscape for startups in emerging fields like social innovation and impact investment. |

Structural reforms taken to enhance the Ease of Doing Business

- Laws have been amended, and rules, regulations and guidelines have been liberalized to reduce the compliance burden. The aim of such amendments or liberalization has been simplification, rationalization, decriminalization, and digitization of the laws and regulations.

- Reduction in corporate taxes.

- Public procurement.

- Phased Manufacturing Programme

- Launching of NSWS (in 2021): It is a one-stop digital platform for investors for approvals and clearances. For this, it has onboarded various ministries/departments at the central and state levels for an enhanced investor experience.

India and Industry 4.0

Industry 4.0 increases efficiency throughout the value chain by integrating cutting-edge technologies like cloud computing, IoT, machine learning, and artificial intelligence (AI) into manufacturing processes. Large-scale adoption of these technologies in India is a work in progress, and important steps taken by the government in this direction are:

- Increasing internet penetration through schemes like Bharatnet.

- Thrust on semiconductor technology and production can unlock hyper-efficient processing technology.

- SAMARTH (Smart Advanced Manufacturing and Rapid Transformation Hubs) Udyog Bharat 4.0 under the Ministry of Heavy Industries and Public Enterprises.

- Aim = to encourage technological solutions to Indian manufacturing units through awareness programmes and demonstrations.

- The establishment of the Centre for 4th Industrial Revolution in India in 2018 aimed at developing policy frameworks for emerging technologies.

Conclusion and Outlook

- India’s industry continues to grow in an environment of global uncertainty due to strong domestic demand, robust financial sector, high Capex and improved corporate balance sheet. This momentum will be retained if global output returns to normal and supply chain disruptions are negated.