IMF Full Form Explained: A Global Financial Institution

IMF Full Form

The IMF full form representing International Monetary Fund. It was established as an international organization in July 1944 with the goal of advancing financial cooperation, economic security, inter commerce, and the eradication of poverty worldwide. The IMF is run by the board of directors, each of whom is representative of a member country. It has over 190 participant nations and is headquartered in Washington D.C.

In order for the nations to conduct business with one another, the IMF’s main objective is to create a stable international financial system, stable currency exchange system, and stable international payments system. It accomplishes this in three ways:

- Maintain a log of the world markets and the economy of its member nations.

- Lending to nations who are having balance of payments issues.

- Providing representatives with useful assistance.

- Extending credit to countries experiencing imbalances in their economy.

- In 2012, the scope was expanded to include any macroeconomic and financial sectors issues that have an influence on global sustainability.

History of IMF

During a UN meeting in July 1944 in Bretton Woods, New Hampshire, the United States, the idea for the IMF, also called the Fund, was conceived. In the meeting, 44 countries agreed to create a foundation for economic cooperation in order to prevent a recurrence of the competitive devaluation that had exacerbated the 1930s Great Depression.

A nation has to be an IMF member in order to be eligible to join the International Bank for Reconstruction and Development (IBRD).

In accordance with the Bretton Woods Agreement, which aimed to promote global financial cooperation, the IMF established a system of convertible currencies with fixed exchange rates and swapped out goods for the U.S dollar, which was valued at $35 per ounce.

The IMF supported the floating exchange rate system when the Bretton Woods system, which had fixed exchange rates, failed in 1971. Since each nation is free to select its own exchange system, market forces control how much each country’s currency is worth in relation to the other. Even now, this system is still in use.

According to IMF estimates, during the 1973 oil crisis, the foreign debts of 100 developing nations that imported oil rose by 150% between 1973 and 1977. The situation was made more problematic by the global switch to floating exchange rates. Between 1974 and 1976, the IMF ran a brand new loan initiative known as the Oil facility. It was accessible to countries experiencing severe issues with their trade balance as a result of the increase in oil prices. One of the main institutions of the global economic system was the IMF, whose architecture permitted integrated liberalism- the balancing of national economic sovereignty and human happiness with the reconstruction of global capitalism.

The former Soviet bloc’s countries needed assistance moving from central planning to market driven economies, and the IMF was a key player in that process. A wave of financial crises engulfed East Asia in 1997, extending from Korea to Thailand and Indonesia.

To help the most impacted economies avoid default, the International Monetary Fund prepared a number of bailouts, or rescue packages, and tied them to changes in the banking, financial, and currency system.

Global Economic Crisis (2008): In response to a world that is becoming more linked and globalized, the IMF launched significant efforts to bolster monitoring.

These measures included reworking the surveillance laws to include spillovers- the phenomenon where economic policies in one nation have an impact on neighboring ones- deepening the examination of risks and financial systems, accelerating evaluations of members’ external positions, and reacting to member concerns sooner.

Duties of the IMF

- It can prevent changes in the exchange rates from occurring, maintaining exchange stability.

- By lending or selling member’s foreign currencies, member nations can reduce the deficit in their balance of payments.

- In the event that the economies of its representatives undergo significant transformations, it could motivate its constituents to modify their par value of its currencies.

- It provides member nations with suggestions on economic and monetary matters to aid in the stabilization of their own economies.

- It might identify a currency as being highly sought after and rare. By borrowing it from or buying it in return for gold from the relevant nation, it may become more accessible.

- It allows members to borrow from the IMF in return for their home currencies. The borrowing countries are compelled to buy back their currencies by repaying debts in convertible currencies.

- It gives member nations access to technological support. It can deploy outside experts to give technical help to the Member states, or it can provide its own resources to its professionals and experts.

Functions of IMF

- Offers Financial Assistance: The IMF loans money to the member nations that struggle with their balance of payments in order to support their efforts to restock foreign reserves, stabilize their currencies and improve the environment for economic expansion. Government must implement structural adjustment plans under IMF supervision.

- IMF monitoring: It keeps an eye on 190 member nations financial and economic policies in addition to supervising the global monetary system. Within this process, which occurs both globally and nationally, the IMF identifies potential threats to stability and provides recommendations for necessary policy changes.

- Capacity Development: It offers training and technical support to finance ministries, tax authorities, central banks and other economic organizations. This supports nations efforts to increase public income, modernize banking infrastructure, create robust legal frameworks, strengthen governance and improve the reporting of financial and macroeconomic data. Additionally, it aids nations in advancing towards the Sustainable Development Goals (SDGs).

Governance structure of IMF?

Board of governors: Each member nation has one governor and one alternate governor on the Board of Governors. Each member country selects two governors.

It is in charge of choosing or appointing Executive Directors to the Board.

Approving quotas increases, SDR allocation, admission of new members, mandatory removal of members, and amendments to the Article of Agreement and By-Laws.

The International Monetary and Financial Committee (IMFC) and the Development committee provide advice to the Board of Governors.

The IMF and the World Bank Group Boards of Governors generally convene once a year, during the IMF- world Bank Annual Meetings, to discuss the activities of their respective institutions.

Ministerial committees : Two ministerial committees advises the Board of Governors:

- the International Monetary and Financial Committees (IMFC): The IMFC has 24 members drawn from a pool of 190 governors and represents all member countries. It discusses the administration of the global monetary and financial system. It also discusses the Executive Boards proposals to amend the Articles of Agreement, as well as any other common concern affecting the global economy.

- Development Committee: is a joint committee (25 members from the IMF and World Bank Boards of Governors) tasked with advising the IMF and World Bank Boards of Governors in issues concerning economic development in emerging markets and developing countries. It us a forum for achieving intergovernmental agreement on critical development issues.

Executive Board of IMF: Is composed of 24 members who are elected by the Board of Governors. It manages IMF’s day to day operations and exercises the powers delegated to it by the Board of Governors and concerned on it by the Articles of Agreement. It covers all aspects of the Fund’s work, from the IMF staff’s annual health checks of member countries’ economies to global economic policy issues. The Board usually makes decisions by consensus, but formal votes are taken on occasion.

IMF management: The managing Director of IMF is both the chairman of the IMF’s Executive Board and the head of IMF Staff. The Executive Board appoints the managing director by vote or consensus.

IMF members: Any other state, whether or not the member of the United Nations, may join the IMF in accordance with the IMFs Article of Agreement and the terms set by the Board of Governors.

Membership in the IMF is required before joining the IBRD.

Pay a subscription fee: When a country joins IMF, it pays a quota subscription, which is calculated based on the country’s wealth and economic performance (quota formula). It is a weighted average of GDP (with a 50% weightage)

Openness 30%

Economic volatility 15%

Foreign reserves 5%

The GDP of each country is calculated using a combination of GDP based on market exchange rate 60% and PPP exchange rates 40%.

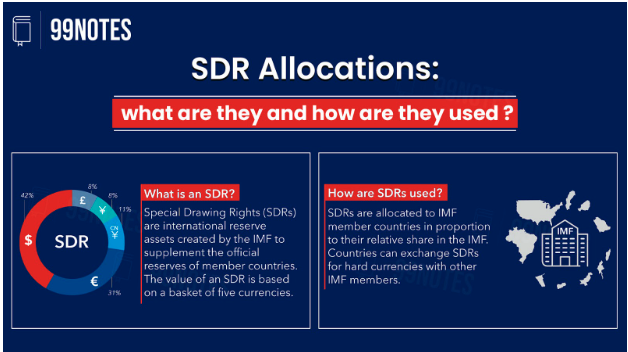

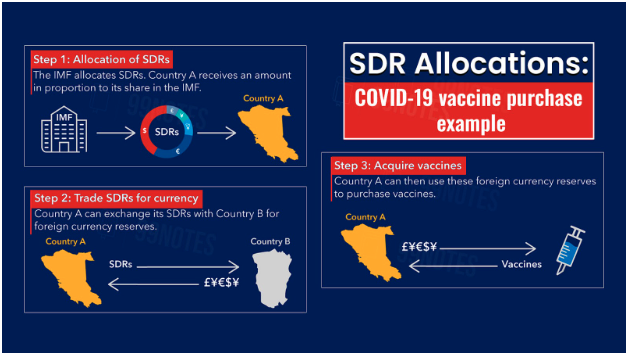

What are SDRs?

SDRs are Special Drawing Rights by the IMF.

The IMF’s unit of account, Special Drawing Rights (SDR) is not a currency.

The SDR’s currency value is determined by adding the value of an SDR basket of currencies in US dollars based on market exchange rate.

The SDR basket consists of the US dollars, Euro, Japanese yen, Pound sterling, and the Chinese renminbi.

The SDR value is calculated daily.

SDRs are used to denominate (express) quotas.

SDRs are claims to currencies held by IMF member countries that can be exchanged .

The voting power of members is directly proportional to their quotas (the amount of money they contribute to the institutions).

The IMF allows each member country to determine the exchange value of its currency in its own way. The only requirements are that the members no longer base the value of its currency on hold (which has proven to be rigid) and that it informs other members precisely how the currency’s value is determined.

SDR basket is reviewed every five years.

FAQ’s Related to IMF full form

Yes, India is a member of the IMF.

What is the purpose of the IMF?

The IMF promotes global macroeconomic assistance to countries and financial stability as well as policy advice and capacity development assistance to countries seeking to build and sustain strong economies.

The IMFs resources are mainly derived from the money paid by countries as capital subscriptions (quotas) when they become members. Each IMF member is assigned a quota based on its relative position in the global economy.

India joined the IMF on 27 December,1945.

Other Related Links:

| Full Form | UNESCO Full form |

| SAARC full form | ASEAN Full form | WHO Full Form | UNICEF Full form |

| CRZ Full Form | BRICS Full Form |

| COP Full Form | UPSC Notes |