7 December 2024 : Daily Current Affairs

1. Balance Between Growth And Inflation Is Unsettled, Says RBI Governor Das

(Source – The Hindu, Business, Page No. – 11)

| Topic: GS3- Indian Economy |

| Context |

|

Monetary Policy and Inflation-Growth Balance

- The Monetary Policy Committee (MPC) is focused on restoring the balance between inflation and growth, which has been disrupted in recent months.

- The Reserve Bank of India (RBI) will utilize its range of policy instruments to create conditions conducive to achieving this balance.

- The credibility of the flexible inflation-targeting framework must be preserved to ensure long-term economic stability.

- Inflation needs to be reduced to sustainable levels to support balanced and sustained economic growth.

- The RBI emphasizes prudence, practicality, and timing in its policy decisions, underscoring that the timing of actions is crucial to their effectiveness.

FY25 Growth Projections Reduced from 7.2% to 6.6%

- The GDP growth rate slowdown in Q2 is attributed to temporary, specific factors rather than a structural trend.

- The earlier 8% growth rate was not a trend but an average derived from 2021-22 to 2023-24, incorporating the pandemic rebound effect.

- Global growth projections for 2024-25 and 2025-26 are similarly adjusted for cyclical corrections post-pandemic, not reflecting long-term trends.

- H2 projections show a recovery with growth rates between 6.9% and 7.3%, signaling a gradual return to higher growth levels by FY25-26.

Liquidity Concerns

Tight liquidity conditions are anticipated in the coming months due to several factors:

- Tax-related outflows, including direct taxes in December and Goods and Services Tax (GST) collections.

- Increased currency in circulation driven by the busy agricultural credit season and cash requirements for the harvest season.

- Significant capital outflows in October and November as Foreign Portfolio Investors (FPIs) exited the market.

- The recent increase in the Cash Reserve Ratio (CRR) was a temporary measure that has served its purpose and has now been normalized.

Growth and Inflation Dynamics

The balance between growth and inflation has been disrupted:

- Growth momentum has slowed, with Q2 GDP growth moderating.

- Inflation surged due to steep increases in food prices, driven by weather-related factors.

- September and October inflation rates were higher than expected, particularly in food inflation, which exceeded estimates.

- The RBI’s immediate goal is to reduce inflation closer to its target to stabilize the growth-inflation dynamic.

Differences Between RBI’s GDP Estimate and Q2 Data

- On the demand side, the primary challenge is reduced investment activity.

- On the supply side, manufacturing is facing a downturn due to weak sales growth and inflation’s impact on urban consumer demand.

- Businesses are hesitant to invest in new assets, as moderate demand can be met with existing capacity, further suppressing investment growth.

Secured Overnight Rupee Rate (SORR)

- A new benchmark index developed by Financial Benchmarks India Ltd. (FBIL) will now include all secured transactions, addressing gaps in the existing MIBOR (unsecured transactions) and MROR (market repo) indices.

- This new index will also integrate TREPS (Treasury Bill Repos), which accounts for 60% of market activity, creating a more comprehensive and accurate benchmark.

Potential Tariff War Implications

- A hypothetical tariff war, if triggered, could result in retaliatory measures from affected countries, such as China devaluing its currency or imposing retaliatory tariffs.

- Such events are difficult to predict in isolation, as they would likely be accompanied by broader economic repercussions, making their unilateral impact uncertain.

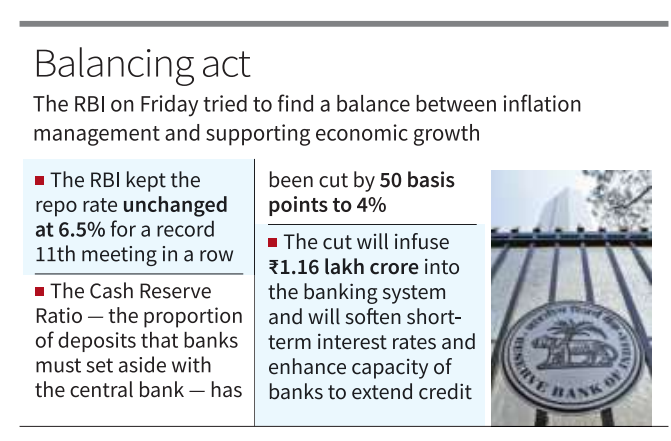

2. Amid high inflation, RBI keeps repo rate at 6.5%

(Source – The Hindu, Page No. – 1)

| Topic: GS3- Indian Economy |

| Context |

| Recently the RBI’s Monetary Policy Committee (MPC) maintained the repo rate at 6.50% for the 11th consecutive review, reflecting a cautious stance amid slowing growth and elevated inflation. |

Policy Repo Rate

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) kept the policy repo rate unchanged at 6.50% for the 11th consecutive bi-monthly review.

Cash Reserve Ratio (CRR)

- The RBI reduced the Cash Reserve Ratio (CRR) by 50 basis points (bps) to 4% after a gap of four years.

- This measure, aimed at addressing persistent tight liquidity, will be implemented in two tranches of 25 bps each starting December 14 and December 28, 2024.

- The CRR cut will release ₹1.16 lakh crore of primary liquidity into the banking system to support growth.

Growth Projections

- The MPC observed a slowdown in growth momentum, leading to a downward revision of GDP growth forecasts for 2024-25 from 7.2% to 6.6%.

- Real GDP growth in the July-September 2024 quarter dropped to 5.4%, the lowest in seven quarters, against the RBI’s earlier projection of 7%.

Inflation Outlook

- Retail inflation rose to 6.2% in October 2024, driven by unexpected increases in food prices.

- The RBI revised its inflation forecast for 2024-25 upward to 4.8% (from 4.5% projected earlier).

- Food inflation pressures are expected to ease from Q4 of 2024-25, aided by seasonal corrections in vegetable prices, arrivals of the kharif harvest, a strong rabi crop outlook, and adequate cereal buffer stocks.

Risks to Inflation Stability

- Inflation risks remain due to adverse weather events, geopolitical uncertainties, and financial market volatility.

Monetary Policy Stance

- The MPC maintained a neutral stance, balancing between controlling inflation and supporting economic growth.

- The committee emphasized the need for durable price stability to establish a foundation for sustainable growth.

Liquidity Measures

- To ease potential liquidity stress from tax outflows (direct taxes and GST), the CRR cut was aligned with the RBI’s neutral policy stance.

Foreign Currency Deposits (FCNR-B)

To attract capital inflows, the RBI raised the interest rate ceiling on FCNR(B) deposits:

- Deposits with maturities of 1 to less than 3 years: Increased from the Alternative Reference Rate (ARR) + 250 bps to ARR + 400 bps.

- Deposits with maturities of 3 to 5 years: Increased from ARR + 350 bps to ARR + 500 bps. This relaxation will be effective until March 31, 2025.

Key Observations by the Governor

- RBI Governor Shaktikanta Das highlighted that persistently high inflation is eroding disposable incomes and denting private consumption, adversely affecting real GDP growth.

- While growth outlook remains resilient, the situation warrants close monitoring.

- The RBI has adopted a prudent and cautious approach, awaiting better visibility on inflation and growth trends before making further policy adjustments.

Conclusion The MPC reiterated its commitment to maintaining the balance between inflation control and growth promotion in the overall interest of the economy.

3. Cyclone Fengal: How a Low-Intensity Storm Unleashed Widespread Destruction

(Source: Indian Express; Section: Explained; Page: 18)

| Topic: GS1 – Geography |

| Context: |

|

Analysis of News:

What are Cyclones?

- The word Cyclone is derived from the Greek word Cyclos meaning the coils of a snake.

- It was coined by Henry Peddington because the tropical storms in the Bay of Bengal and the Arabian Sea appear like coiled serpents of the sea.

- Cyclones are powerful, rotating storms that form over warm ocean waters, characterized by low pressure at the center and high winds.

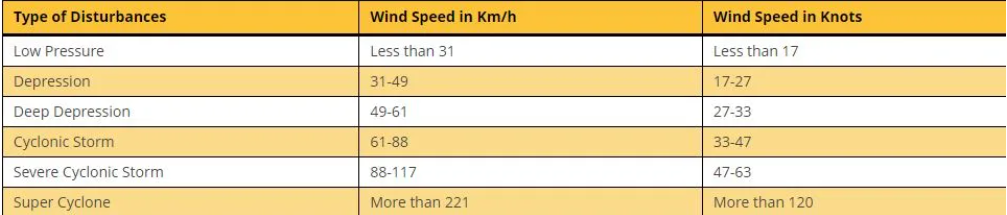

Categories of Cyclones

The India Meteorological Department (IMD) classifies cyclones by wind speeds:

- Fengal, with wind speeds of 75-95 kmph, was a cyclonic storm — less intense compared to severe storms like the Odisha Super Cyclone (1999) or Cyclone Amphan (2020).

Impact of Cyclone Fengal

Fengal triggered intense rainfall and flooding across Tamil Nadu and Puducherry:

- Villupuram’s Mailam village recorded 510 mm of rainfall in 24 hours.

- Puducherry received 490 mm of rainfall in a single day, surpassing its previous record of 211 mm in 2004.

Transport infrastructure suffered, with air, rail, and road disruptions, while overflowing lakes and rivers worsened flooding in affected areas.

Reasons for Widespread Destruction

- Slow Movement: Fengal moved at speeds as low as 6 kmph and remained stationary for 12 hours after landfall. This prolonged its impact, intensifying rainfall and wind damage.

- Persistent Intensity: Unlike typical cyclones that weaken rapidly after landfall, Fengal maintained its strength, leading to extended periods of destruction.

- Excessive Rainfall: The slow-moving nature of the storm contributed to record-breaking downpours, inundating large areas and overwhelming drainage systems.

Comparison with Recent Cyclones

- More intense cyclones, such as Dana in October, caused fewer human casualties due to better disaster preparedness and faster storm progression.

- Fengal’s stationary nature and slow movement highlighted unique challenges, underscoring the need for enhanced mitigation strategies even for low-intensity storms.

Conclusion

- Cyclone Fengal demonstrates how even low-intensity cyclones can cause disproportionate destruction due to factors like slow movement and persistent rainfall.

- Its impact underscores the importance of adaptive disaster management strategies tailored to unique storm behaviors.

| How a Cyclone is formed? |

|

Conditions:

Formation of a Low-Pressure System:

Cyclonic Circulation:

Dissipation:

|

| PYQ: Tropical cyclones are largely confined to South China Sea, Bay of Bengal and Gulf of Mexico. Why? (150 words/10m) (UPSC CSE (M) GS-1 2014) |

| Practice Question: Cyclone Fengal, despite being classified as a low-intensity storm, caused significant destruction in Tamil Nadu and Puducherry. Analyze the reasons for this widespread impact and compare it with the effects of more intense cyclones in recent years. How can disaster management strategies be improved to mitigate such destruction in the future? (250 words/15 m) |

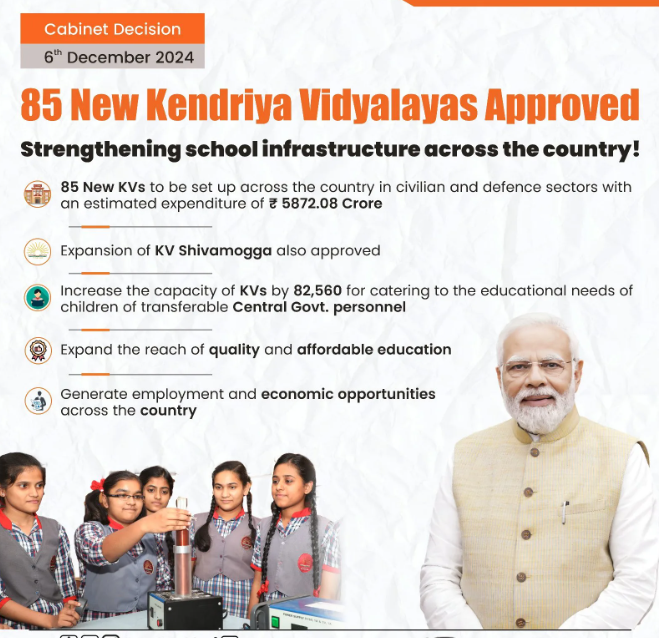

4. Union Cabinet Approves ₹8,231 Crore Plan for Largest Expansion of Central Schools

(Source: Indian Express; Section: Cover Page; Page: 01)

| Topic: GS2 – Governance |

| Context: |

|

Analysis of News:

KVs and JNVs: Purpose and Reach

Kendriya Vidyalayas (KVs):

- Aimed at children of central government and defence personnel, 85 new KVs will cater to urban demand, prioritizing areas with a significant presence of central employees.

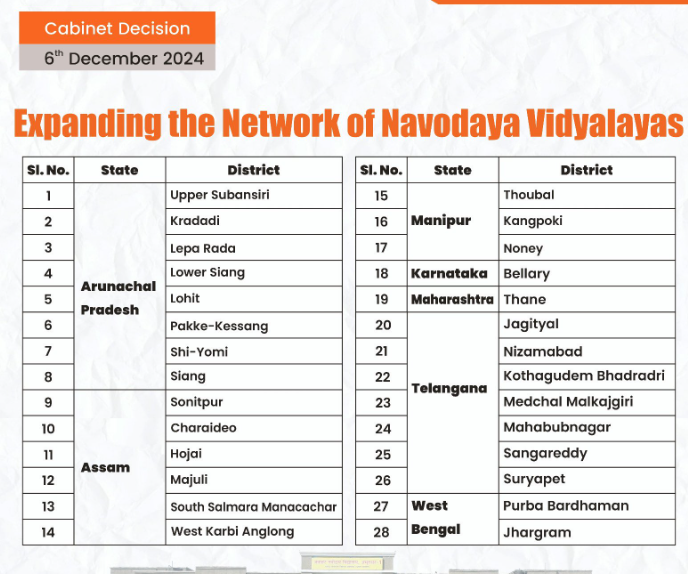

Jawahar Navodaya Vidyalayas (JNVs):

- Residential schools targeting rural talent, 28 new JNVs will focus on border and underserved regions, especially in the Northeast.

- Currently, India has 1,256 functional KVs and 653 operational JNVs.

Timeline and Capacity Expansion

- KVs: To be established over eight years starting in 2025-26.

- JNVs: Scheduled over five years (2024-25 to 2028-29).

- Impact: These schools will create an additional enrollment capacity for nearly one lakh students and approximately 6,600 new job opportunities.

Regional Prioritization

- Jammu & Kashmir: Largest allocation of 13 KVs, catering to families of CRPF personnel.

- Northeast: 17 JNVs for Arunachal Pradesh (8), Assam (6), and Manipur (3) reflect a strategic focus on border regions.

- Other Key States: Madhya Pradesh (11 KVs), Rajasthan (9 KVs), Andhra Pradesh (8 KVs), and Odisha (8 KVs).

Challenges and Lessons from Past Expansions

- Previous Approvals: Similar large-scale expansions in 2014 (54 KVs) and 2019 (50 KVs). While operational, many still function from temporary premises.

- Implementation Challenges: Ensuring timely construction of permanent buildings and necessary facilities will be critical to achieving the full impact of this expansion.

Conclusion

- This ambitious expansion underscores the government’s commitment to strengthening school education infrastructure, particularly for underserved and border regions.

- Effective execution will be key to maximizing the benefits for students and communities nationwide.

| Practice Question: Discuss the significance of the Union Cabinet’s decision to expand Kendriya Vidyalayas (KVs) and Jawahar Navodaya Vidyalayas (JNVs) in addressing educational needs across India. Highlight the challenges in implementation and suggest measures to ensure effective outcomes. (250 words/15 m) |

Prelims Facts:

1. Centre To Develop Four New Tourist Destinations In J&K With Help From World Bank

(Source – The Hindu, Section: New; Page: 05)

| Context |

|

- Increase in Tourism in J&K: Jammu and Kashmir has witnessed a rise in tourist footfall, with 1.2 million tourists visiting in the first half of 2024.

- Development of New Tourist Destinations: Four new destinations—Kokernag (Anantnag), Baradari (Reasi), Bhadarwah (Doda), and Doodhpathri (Budgam)—have been chosen for development into world-class tourist spots.

- Partnership for Development: The projects are a joint venture between the World Bank, the Jammu and Kashmir Government, and the Central Government.

- Role of the World Bank:

- Acts as a knowledge partner for development.

- Supports promotion of the handicrafts industry.

- Focuses on ecological sustainability in development plans.

- Selection Process: The destinations were finalized following a visit by a World Bank delegation in September 2024.

- Existing Popular Spots: Gulmarg, Pahalgam, and Katra Vaishno Devi are already well-known tourist destinations in the region.

| World Bank |

|

Purpose: Provides loans and grants to low and middle-income countries to reduce poverty and support economic development. Key Institutions: Comprises five institutions, with IBRD and IDA being the main funding arms. Focus Areas: Supports infrastructure, education, healthcare, and environmental projects. Global Impact: Aims to improve living standards and promote sustainable growth. Funding Mechanism: Offers financial resources, policy advice, and technical support. Headquarters: Based in Washington, D.C., USA. |

2. PM e-VIDYA Channel 31: A Milestone for Inclusive Education in Sign Language

(Source: Indian Express; Section: Express Network; Page: 09)

| Context: |

| Union Minister of Education Dharmendra Pradhan inaugurated PM e-VIDYA Channel 31, a DTH channel dedicated to Indian Sign Language, marking a significant step toward inclusivity in education for children with special needs. |

Analysis of News:

Focus on Inclusivity Under NEP 2020

- The launch aligns with the National Education Policy 2020, which emphasizes inclusive education and the welfare of children with special needs.

- Pradhan highlighted that the education system is increasingly prioritizing accessibility and inclusivity for differently-abled individuals.

Sign Language and Cultural Integration

- Pradhan emphasized the cultural relevance of sign language, evident in forms like dance and drama, and stressed its potential to unlock the talents of differently-abled individuals.

- Noting examples from history, such as Soordas and Stephen Hawking, he underscored the untapped potential within the Divyang community.

Broader Impact and Vision

- The channel is a step toward creating a more inclusive and progressive society.

- Indian Sign Language can not only aid education but also generate job opportunities and set international benchmarks.

- Stakeholders are urged to popularize the channel and ensure its reach across the nation.

3. Cabinet approves Rithala-Kundli corridor of Delhi Metro Phase-IV project

(Source – https://pib.gov.in/PressReleasePage.aspx?PRID=2081693)

| Context |

|

Approval of Rithala-Narela-Nathupur Corridor:

- The Union Cabinet, chaired by Prime Minister Narendra Modi, approved the Rithala-Narela-Nathupur corridor under Delhi Metro Phase-IV.

- The corridor spans 26.463 km and aims to enhance connectivity between Delhi and neighboring Haryana.

- The project is scheduled for completion within four years of approval.

Project Cost and Execution

- The estimated cost for the project is Rs. 6,230 crore.

- It will be implemented by the Delhi Metro Rail Corporation (DMRC), a joint venture between the Government of India (GoI) and the Government of National Capital Territory of Delhi (GNCTD), in a 50:50 partnership.

Extension of the Red Line

- The corridor will extend the existing Shaheed Sthal (New Bus Adda)-Rithala Red Line.

- This extension will connect the northwestern parts of Delhi, including Narela, Bawana, and parts of Rohini, improving public transportation in these regions.

Stations and Features

The corridor will have 21 elevated stations:

Rithala, Rohini Sector 25, Rohini Sector 26, Rohini Sector 31, Rohini Sector 32, Rohini Sector 36, Barwala, Rohini Sector 35, Rohini Sector 34, Bawana Industrial Area (sectors 1–4), Bawana JJ Colony, Sanoth, New Sanoth, Depot Station, Bhorgarh Village, Anaj Mandi Narela, Narela DDA Sports Complex, Narela, Narela Sector 5, Kundli, and Nathupur.

Boost to Connectivity in NCR

- Upon completion, the corridor will link Shaheed Sthal New Bus Adda in Ghaziabad, Uttar Pradesh, with Nathupur in Haryana via Delhi, creating seamless connectivity across the National Capital Region (NCR).

- It will improve access to key residential, commercial, and industrial areas, fostering regional integration.

Environmental and Economic Benefits

- The corridor is expected to significantly reduce road congestion and vehicular pollution.

- Improved public transportation will support the local economy by facilitating easier and faster commuting.

Fourth Extension into Haryana

- This corridor marks Delhi Metro’s fourth extension into Haryana, after lines to Gurugram, Ballabhgarh, and Bahadurgarh, further strengthening inter-state connectivity.

Progress of Phase-IV Project

- Phase-IV construction involves three priority corridors spanning 65.202 km with 45 stations, of which 56% of construction has been completed.

- These corridors are expected to be completed in phases by March 2026.

- Two additional corridors (20.762 km) are approved and are in the pre-tendering phase.

Current Delhi Metro Network:

- DMRC operates 12 metro lines covering 392 km with 288 stations across Delhi and NCR.

- The network serves an average of 64 lakh passenger journeys daily, with a record of 78.67 lakh journeys on November 18, 2024.

- Delhi Metro is recognized for punctuality, reliability, and safety, making it a critical part of urban life in the capital.

Delhi Metro’s Achievements

- Delhi Metro has the largest metro network in India and is among the largest globally.

- It continues to set benchmarks for urban transportation with its efficient operations and infrastructure expansion.