8 November 2024 : PIB Summary For UPSC

1. India’s Nutraceutical Industry Poised for Global Growth with Supportive Initiatives

(Source – https://pib.gov.in/PressReleseDetail.aspx?PRID=2071412®=3&lang=1 )

| Topic: GS3 – Indian Economy |

| Context |

| The global nutraceutical market, valued at around $400 billion, offers India immense growth potential due to its Ayurvedic heritage and medicinal resources.However, India’s limited market share calls for targeted policy measures and infrastructure support. |

Overview of the Global Nutraceutical Market

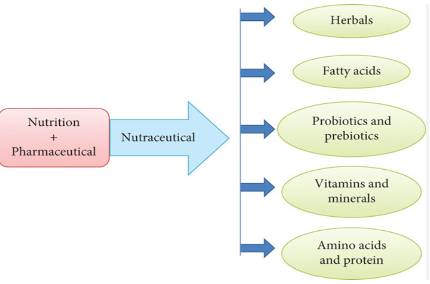

- The global nutraceutical market is valued at approximately $400 billion, merging food, pharmaceuticals, and biotechnology.

- India, with its rich tradition in Ayurveda, plays a crucial role but has less than 2% market share due to limited industry classification, hindering targeted support.

Task Force Initiatives and Policy Developments

- Formation of Task Force (TF): The Council of Scientific and Industrial Research (CSIR) formed a Nutraceutical Sector Task Force in 2021, comprising representatives from key ministries and industry experts.

- Objectives: The TF focuses on creating policy measures, aligning with the “Harmonized System of Nomenclature” (HSN) for standardised trade and other global standards.

Advantages of India in the Nutraceutical Industry

- Traditional Knowledge and Ayurveda: India’s deep-rooted health sciences provide a unique edge.

- Diverse Agro Climatic Zones: India’s 52 zones allow the cultivation of medicinal plants, supporting a strong hub of over 1,700 medicinal plants.

- Pharmaceutical Expertise: The established pharmaceutical industry supports high-quality nutraceutical standards.

- Growing Startup Ecosystem: A vibrant ecosystem fosters innovation and growth in nutraceuticals.

Challenges for India in the Nutraceutical Industry:

- Limited Market Share: India’s global share is under 2%, highlighting a need for greater market access and visibility.

- Lack of Industry Classification: Absence of defined categorization within Indian ministries restricts targeted policies and financial support.

- Regulatory Complexities: Compliance with international standards remains challenging, affecting export competitiveness.

- Insufficient Scientific Validation: Traditional nutraceutical ingredients like Ayurveda-based herbs need rigorous scientific backing to gain global acceptance.

- Export and Trade Barriers: High export costs and complex customs procedures deter international trade.

- Infrastructure Gaps: Limited incubation centers and research hubs slow down innovation and commercialization efforts.

Recent Advancements in the Sector

- HSN Codes and Regulatory Support: The introduction of HSN codes and industry panels under SHEFEXIL supports regulatory compliance.

- PLI Scheme for Nutraceuticals: A dedicated Production-Linked Incentive (PLI) scheme has been established to support growth.

- Export Incentives: Nutraceuticals are classified as food products under FSSAI, eligible for the RoDTEP Scheme, aiding exporters.

Conclusion

- India’s strategic initiatives aim to position the nation as a global leader in nutraceuticals, combining traditional knowledge with modern science.

| Practice Question: Discuss the potential of India’s nutraceutical industry in the global market. Analyse the challenges faced in achieving a substantial market share. Highlight recent policy initiatives to boost sectoral growth and exports. (150 Words /10 marks) |